Our latest views on the US economy and financial markets.

By FPA Investment Team | 4 October 2021

US economy: Review and Outlook

US economy expanded by 6.7% in Q2 2021

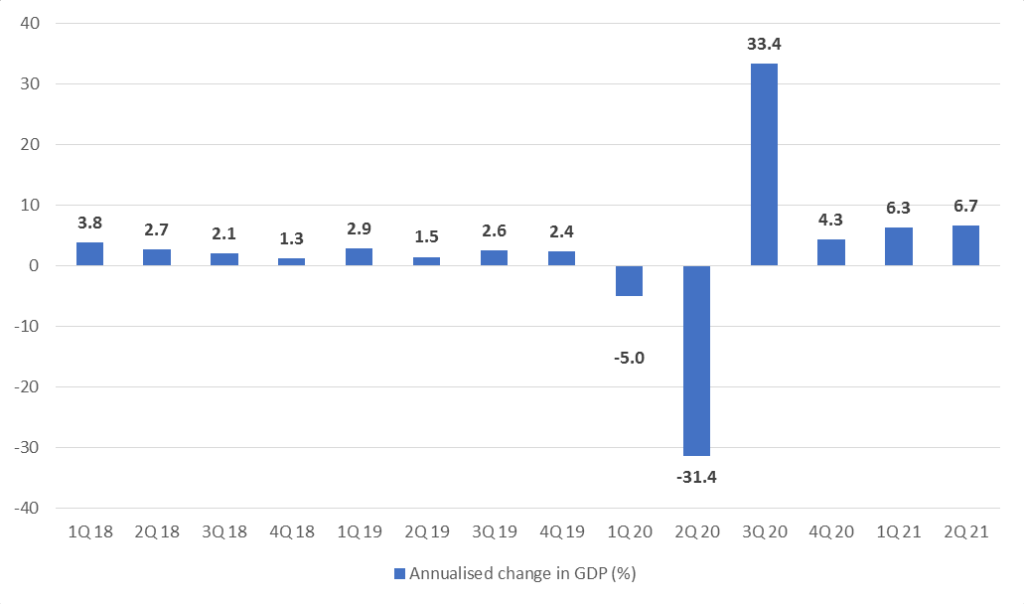

The US economy expanded for the fourth straight quarter in Q2 2021 as the accelerating vaccination campaign, reopening of establishments and fiscal support continued to underpin growth. The third estimate by the Bureau of Economic Analysis (BEA) reflected that US gross domestic product (GDP) rose at an annualised rate of 6.7% in Q2 2021, as shown in Exhibit 1. This followed increases of 33.4%, 4.3% and 6.3% in Q3 2020, Q4 2020 and Q1 2021 respectively.

Exhibit 1: Annualised change in US quarterly GDP

Source: Data compiled from BEA

During Q2, on an annualised basis, personal consumption expenditure rose by 11.9%, government consumption expenditure and gross investment fell by 1.9%, gross private domestic investment fell by 4.0%, exports rose by 6.6% and imports rose by 6.7%. These components contributed 7.80 percentage points (pps), -0.33pps, -0.67pps, 0.70 pps and -0.94 pps to real GDP growth respectively.

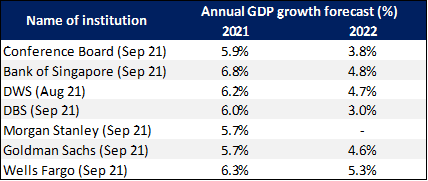

The Conference Board recently highlighted that following the steady economic rebound in H1 2021, it expects the recovery to continue, but moderate somewhat through the remainder of the year. The Conference Board expects the economy to grow at 5.9% this year. This forecast is a downgrade from its August outlook and incorporates the larger-than-expected impact that the COVID-19 Delta variant has had on the US economy. The Conference Board highlighted that the recent decline in consumer confidence owing to a resurgence in pandemic will likely reduce the growth contribution from consumption. Further, bottlenecks in global supply chains made it difficult for businesses to keep up with elevated demand for many goods earlier this year, which will result in a sharp contraction in private inventories.

Likewise, other financial institutions and fund managers have also revised their growth forecast downwards. By and large, concerns that the Covid-19 Delta variant could impact consumer spending, persistent supply chain issues and the drop in fiscal stimulus have been cited as reasons for the downward revision of the growth forecasts. A summary of the GDP forecasts by various financial institutions is shown in Exhibit 2.

Exhibit 2: US GDP growth forecast (% yoy change)

Source: Respective financial institutions

Strong fiscal stimulus to support growth

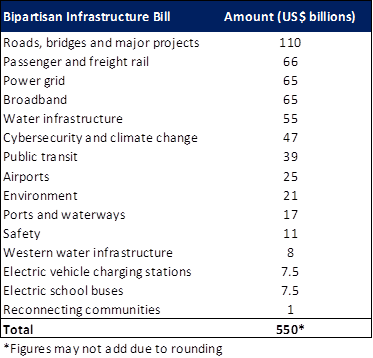

The US$1 trillion bipartisan infrastructure bill will provide further impetus for growth and is a critical step in implementing President Biden’s Build Back Better vision. The bill is expected to include US$550 billion in new federal investment in America’s roads and bridges, water infrastructure, resilience, internet, among others, as outlined below in Exhibit 3.

Exhibit 3: Breakdown of Bipartisan Infrastructure Bill

Source: The White House

However, President Biden previously mentioned that he would not sign the Bipartisan Infrastructure bill into law until the bill containing the rest of his agenda involving childcare, education, the caring economy, clean energy and tax cuts for American families is agreed upon. In a recent meeting at the Capitol, President Biden called on House Democrats to hold off on voting on the US$1 trillion Infrastructure bill until after they reach an agreement on a separate social-policy and climate bill (US$ 3.5 trillion reconciliation bill). Further, US House of Representatives Speaker Nancy Pelosi also stated that she believes the US$3.5 trillion bill will have to be negotiated lower before further advancements can be made.

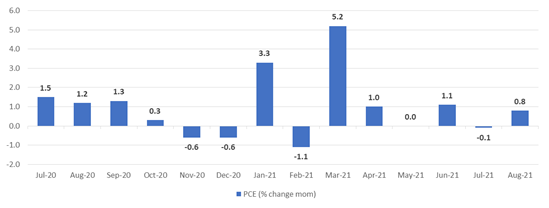

Consumer spending rebounded moderately in August

In August, US consumer spending rose by 0.8 % mom, after a 0.1% decrease in July as shown in Exhibit 4.

Exhibit 4: US monthly personal consumption expenditure (% change mom)

Source: Data compiled from BEA

Within goods, increases in spending for food and beverages as well as “other” nondurable goods (mainly, household supplies as well as recreational items) were partly offset by a decrease in spending for motor vehicles and parts. Within services, the increases were widespread, led by “other” services (mainly, personal care and clothing services), housing and utilities, and health care. Americans’ view of the economy improved slightly in September, according to a University of Michigan survey released Friday. The survey’s consumer sentiment index increased to 72.8 in September from 70.3 in August.

Retail sales rose marginally in August

During the period, US retail & food services sales rose by 0.7% mom to US$ 618.7 billion, reversing a 1.8% contraction in July, according to data from the US Census Bureau. The data for monthly change in retail & food services sales are summarised in Exhibit 5.

Exhibit 5: US monthly retail and food services sales (% change mom)

Source: Data compiled from US Census Bureau

In August, gains in retail sales were fairly broad-based. With many schools, college campuses and offices reopening, consumers shelled out more for groceries and merchandise at big-box stores. Those purchases—along with higher spending on furniture and hardware—offset another big decline in car sales, which have suffered from a global computer chip-shortage that has crimped supply. The report from the Census Bureau showed that rather than clamping down on their spending, consumers may have merely shifted it. Department stores, non-store retailers, furniture stores and grocery stores were among those registering significant sales gains.

Labour market remained resilient

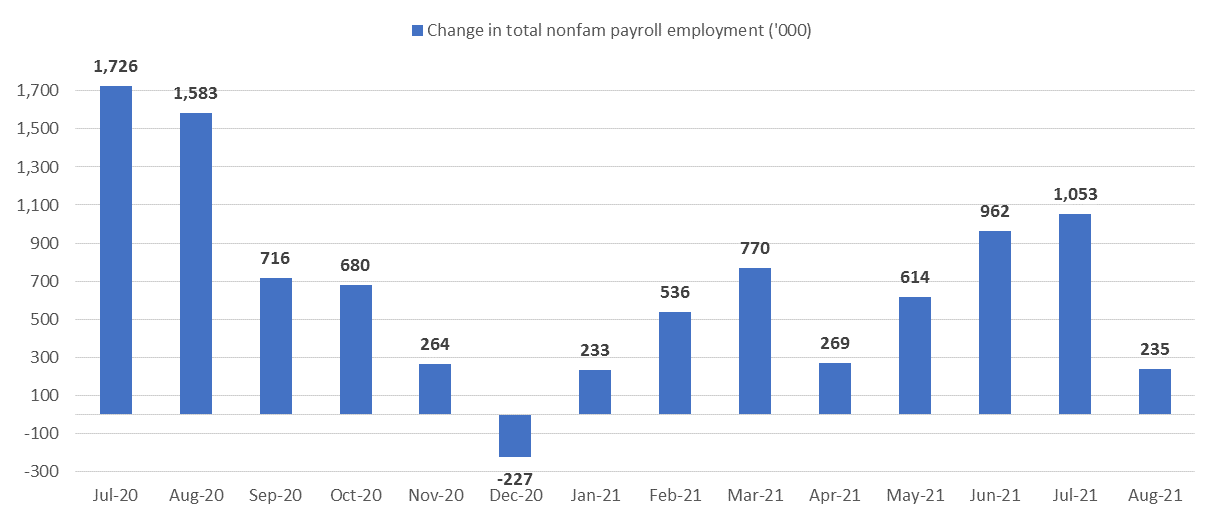

The latest August jobs report by US Bureau of Labour Statistics (BLS) showed that US hiring slowed sharply in August as the surging Delta variant dented the pace of the economic recovery. The US economy added 235,000 jobs in August compared with a revised 1,053,000 jobs in July. There are still 5.3 million fewer jobs in August from its pre-pandemic level in February 2020. The data for monthly change in nonfarm payroll employment are summarised in Exhibit 6.

Exhibit 6: US monthly change in nonfarm payroll employment (in thousands)

Source: Data compiled from BLS

In August, notable job gains occurred in professional and business services, transportation and warehousing, private education, manufacturing, and other services which added 74,000, 53,000, 40,000, 37,000 and 37,000 jobs respectively in August. Employment in retail trade declined by 29,000 over the month. In August, employment showed little change in other major industries, including construction, wholesale trade, and health care. Though job gains are slowing, employer demand for workers persists. The unemployment rate fell to a pandemic low of 5.2% in August from 5.4% in July, as shown in Exhibit 7.

Exhibit 7: US monthly unemployment rate (%)

Source: Data compiled from BLS

The August jobs report suggests that that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages. During the period, average hourly earnings for all employees on private nonfarm payrolls rose by 17 cents to US$30.73, following increases in the prior 4 months. Average hourly earnings of private-sector production and nonsupervisory employees rose by 14 cents to US$25.99.

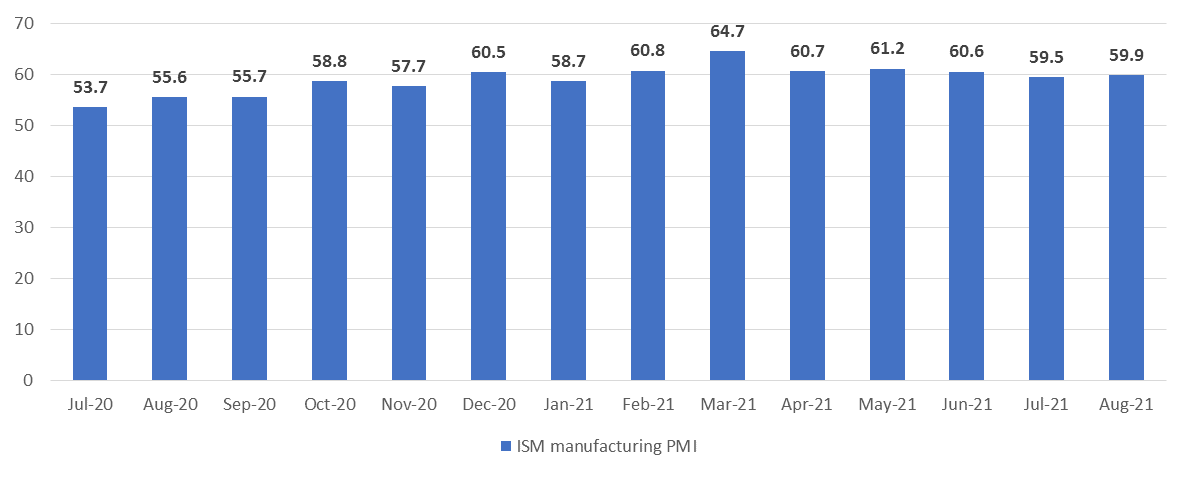

Growth in manufacturing activity rose slightly in August

In August, supply chain bottlenecks and shortages of key component problems persisted, and businesses say they are still struggling to find workers to keep up with the demand. The latest survey by the Institute for Supply Management (ISM) showed that manufacturing PMI in August was at 59.9, increased slightly from July’s 59.5, remaining at historically high levels. The data for ISM monthly ISM manufacturing PMI are summarized in Exhibit 8.

Exhibit 8: ISM monthly manufacturing PMI

Source: Data compiled from ISM

The survey showed record-long raw-materials lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. According to ISM, companies and suppliers continue to struggle at unprecedented levels to meet increasing demand. Worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions and overseas supply chain problems continue to limit manufacturing-growth potential. However, due to the desperate need for restocking, manufacturing output could continue to expand even if demand didn’t grow at all.

Meanwhile, the IHS Markit’s flash US manufacturing PMI fell to 60.5 in September from 61.1 in August. IHS Markit said that overall growth was supported by a robust increase in new business. New orders were reportedly driven by strong demand conditions. However, supply constraints and material shortages dampened output in September. Although strong, the rate of expansion in production was the slowest for 11 months. Lead times lengthened substantially as trucking issues and capacity shortages led to one of the greatest deterioration in vendor performance on record. Chris Williamson, Chief Business Economist at IHS Markit highlighted that supply chain delays show no signs of easing, with another near-record lengthening of delivery times in September. Hence, factory output growth also weakened and order book backlogs rose at a record pace in September, he added.

Housing market cooled slightly in August

In August, the median price for existing home sales rose to US$356,700 in August, according to the National Association of Realtors (NAR). Prices rose by 14.9% yoy in August, marking 114 straight months of year on year gains. Homes on the market typically sold in 17 days in August, unchanged from July and down from 22 days in August 2020. According to NAR, existing home sales declined by 2.0% in from July to August, the biggest monthly decline since April. NAR’s chief economist Lawrence Yun highlighted that although there was a decline in home purchases, potential buyers are out and about searching, but much more measured about their financial limits, and simply waiting for more inventory. In August, supply totalled 1.29 million homes for sale, 1.5% lower than in July and 13.4% lower than what was available in August 2020. At the current sales pace, there was a 2.6-month supply of homes on the market at the end of August. Further, according to Freddie Mac, the 30-year fixed mortgage rate was 2.84% in August, down from 2.87 in July and lower than the average rate of 3.11% in 2020.

Meanwhile, latest data from the US Census Bureau showed that new home sales rose by 1.0% mom to a seasonally adjusted annual rate of 740,000 in August, following a 1.0% increase in July. The August sales gain was driven by a pickup in homes not yet started, indicating construction activity will remain firm in the months ahead. However, while underlying demand is solid, builders are struggling to fill orders because of unsteady supply chains and difficulty finding workers. At the current sales pace, it would take 6.1 months to exhaust the supply of new homes, compared with 6 months in July and 3.6 months at the start of the year.

Boost in taxes collection narrowed the budget deficit in August

The US budget deficit narrowed to US$2.7 trillion during the first 11 months of the fiscal year from US$3 trillion in the same period a year ago, with the gap between spending and revenue declining as the recovery from a pandemic-induced slump boosted taxes. Spending has been boosted by pandemic-related costs, while revenue increased largely due to higher receipts from individual and corporate income taxes. The deficit for August was US$171 billion and compared with $200 billion a year earlier. Revenue increased by 20% to US$268 billion in August compared with the same month last year. Spending for the month increased by 4% to US$439 billion.

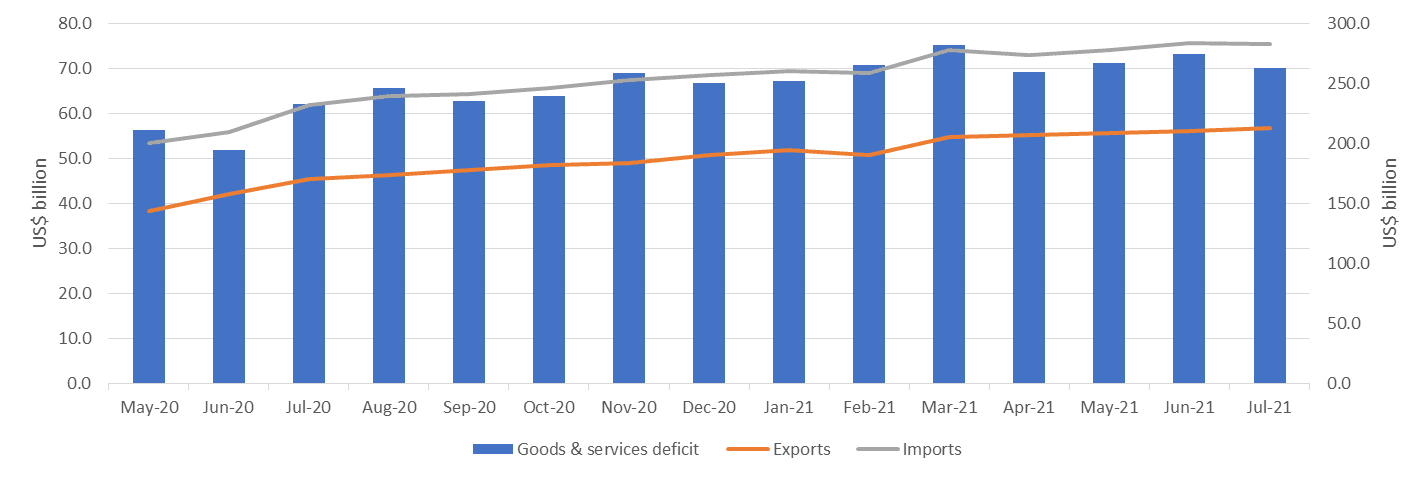

Gains in exports narrowed the trade deficit in July

The US trade deficit narrowed in July as consumers and businesses pulled back on purchases of imported goods. During the period, exports rose by 1.3% yoy to US$212.8 billion, while imports fell by 0.2% to US$282.9 billion, according to the BEA. As a result, the goods and services deficit narrowed to US$70.1 billion in July. The data for monthly US goods and services deficit, exports and imports are summarised in Exhibit 9.

Exhibit 9: US monthly goods and services deficit, exports and imports (in US$ billion)

Source: Data compiled from BEA

The increase in exports and the narrowing of trade deficit was helped in part by a rebound in auto shipments, which had been suppressed by a semiconductor shortage in recent months. Meanwhile, imports fell as demand slowed for consumer goods including toys, sporting goods and cellphones. Purchases of industrial supplies and material also declined. In July, Americans grew more cautious about spending amid the spread of the highly contagious Delta variant of the Covid-19 virus. WSJ highlighted that the solid growth in exports reflected the continued recovery in economies around the world, which drove the sales higher for industrial machinery, consumer goods and autos.

Equities: Review and Outlook

Over the past 2 months, the DJIA fell by 0.75% to 34,607.72, the S&P 500 rose by 2.04% to 4,458.58 and the NASDAQ rose by 2.81% to 15,115.49. Growth stocks, in particular in the technology sector, corrected as mounting inflation concerns led to a rise in bond yields. In contrast, value stocks continued to outperform as investors positioned for the economic recovery from the Covid-19 crisis, underpinned by increased vaccine distribution and massive fiscal stimulus. Valuations appear expensive, as the MSCI US was recently trading on a forward PE and PB multiple of 22.10x and 4.92x respectively, above their historical averages. Below, we discuss the outlook for the US stock markets, taking into account positive factors which could drive equities higher, as well as risk factors that could limit upside.

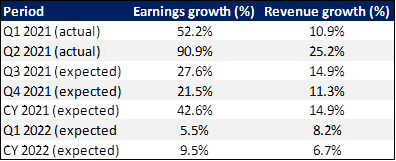

Stellar corporate earnings in Q2

Recent news suggest that the delta variant does not appear to have caused a notable rollback of capital spending intentions among companies. According to a recent Factset report, approximately 87% of S&P500 companies have beaten analysts’ earnings and sales estimates Q2. Further, aggregate corporate profits are up nearly 90.9% in Q2 2021 – the highest since Q4 2009. The actual and projected earnings and revenue growth for the S&P 500 by Factset are summarised in Exhibit 10.

Exhibit 10: Factset’s earnings and revenue growth for S&P 500

Source: Factset

Against this positive backdrop, we note that financial institutions like UBS, Goldman Sachs and Wells Fargo have recently upgraded their 2021 S&P 500 targets. UBS recently raised its S&P 500 2021 target to 4,600 from 4,500, and revised upwards its 2021 S&P 500 earnings per share forecast to US$207, representing a 45% yoy growth. The firm also expects to see a further yoy increase of 10% in 2022 S&P 500 earnings growth to US$227. Similarly, other financial institutions like Goldman Sachs and Wells Fargo have also recently upgraded their 2021 S&P 500 targets. Others including Citi and Credit Suisse have maintained their forecasts. The 2021 S&P targets by various financial institutions are summarised in Exhibit 11.

Exhibit 11: 2021 S&P 500 targets

Source: respective financial institutions

Strong fiscal stimulus

The bipartisan infrastructure bill is a critical step in implementing President Biden’s Build Back Better vision and will provide further impetus for growth. We believe that the US equity market is likely to benefit from the increase in infrastructure spending as the bill includes US$550 billion in federal investment in new infrastructure over the next 5 years in areas such as upgrading of roads, bridges, ports and green energy. However, we believe that stock selection is key as not all industries stand to benefit from this infrastructure bill.

Below we note that there are downside risks that could have a negative impact on the stock market.

Risk factors

I. Rising inflation concerns

Rising inflation concerns and the prospect of tighter monetary policy have led to a sharp increase in bond yields which weighed on sentiment in the stock market. Tech growth stocks in particular had corrected as investors pivoted to cyclical and value names that are likely to benefit from the economic recovery. Recent indicators suggest that prices have remained high, largely owing to supply shortages, bottlenecks and base effects. The risk for inflation surprises and the central bank’s policy would be important for investors to follow. If the Fed were to prompt a sooner-than-expected rate hike, the stock market could undergo another correction.

II. Increasing regulatory scrutiny in China

Chinese authorities have introduced a slew of legislation in the past few months which has ensnared sectors from technology to education and to property, wiping hundreds of billions off the market capitalisation of some of its largest companies. According to the China Securities Regulatory Commission, the increased in regulatory scrutiny is targeted to strengthen the regulation of consumer-facing platform companies with a key role in promoting “common prosperity” and easing wealth inequality. If regulatory scrutiny were to persist, US companies which generate substantial revenue & earnings from China could be negatively impacted.

III. Biden’s tax proposals could hurt corporate earnings

Under President Biden’s tax proposals, the US corporate tax rate would be raised to 26.5% from 21% and the top individual income tax rate to 39.6% from 37%. The White House also wants to raise the capital gains tax rate on those making more than US$1 million a year from the current 20% rate to 39.6%.

In terms of projections, Wells Fargo Investment Institute expects corporate income taxes to reset to 25%-26%. This is similar to our base case scenario of an increase to 25% from 21%. Meanwhile, Wells Fargo also expects the top-tier individual income tax rate to revert back to pre-2017 levels and capital gains rates to land in the upper 20% range. Should the tax proposal materialise and become law by year-end, stocks could see some selling pressure as investors brace for hits to corporate profits and capital gains.

IV. Surging oil prices

Recently, Brent crude oil jumped to a three-year price high above US$80 a barrel, sparking fears of a deepening global energy crunch that has already pushed natural gas & coal prices in Europe and Asia to record highs. The strong increase in energy prices comes as businesses and consumers increase their usage of everything from petrol to plane fuel at a time when governments are lifting social curbs imposed. Goldman Sachs expects the rally to continue and raises its end-of-year Brent crude oil forecast US$90 from US$80, citing that supply is now short of demand as economies recover, with global crude stockpiles shrinking at record pace. Overall, the continued rally of oil prices could increase input costs and weigh on the growth of corporate profits.

V. Virus-related and geopolitical risk

It has been reported that the Delta variant’s deadly surge through the US is levelling off. Public-health researchers have chalked up the easing in the Delta surge to a range of factors. Spikes in hospitalizations and deaths may have encouraged some people to take more precautions, and Delta’s rapid spread may have boosted the ranks of people who now carry immune protection from infections and helped slow down the spread of the virus. However, the variant’s high transmissibility combined with the relaxation of precautions such as wearing masks have caused clusters infections among unvaccinated citizens across the country. If this situation persists, there is a possibility that the government could re-introduce lockdowns measures which could derail the strong corporate earnings growth trajectory.

Meanwhile, recent developments suggest that US-China tension could continue to deteriorate. The UK, US and Australia recently announced a historic security pact (Aukus pact) in the Asia-Pacific. Under the pact, the US and the UK will help Australia to acquire nuclear-powered submarines and work together in the Indo-Pacific region, where the rise of China is seen as an increasing threat, to develop wider technologies. Further, President Biden also recently hosted the Quadrilateral Security Dialogue (Quad) with Japan, India and Australia to reiterate their commitment to a free and open Indo-Pacific region. Overall the US’s increasing presence in the Indo-pacific region could worsen US-China relations and potentially weigh on investors’ sentiment.

The positive and negative factors for the US stock market are summarised in Exhibit 12 below.

Exhibit 12: Summary of positive and negative factors for the US stock market

| Positive factors | Negative factors |

|

Companies have reported better-than-expected sales and earnings results in Q2

|

Rising inflation concerns

|

|

Strong growth outlook anchored by fiscal stimulus

|

China regulatory scrutiny

|

Proposed tax hikes by Biden Administration

|

|

|

Surging oil prices

|

|

Virus resurgence and geopolitical risk

|

We note that strong economic growth and better-than-expected S&P 500 earnings growth of 90.9% in the second quarter has helped to support a continued rally in US stocks. As a result, financial institutions have recently upgraded their 2021 S&P targets on the back of a stellar US corporate earnings season. In addition, the Bipartisan Infrastructure Bill could also benefit certain sectors due to increase in spending on infrastructure projects and other green sectors (electric vehicles and renewables). However, the Federal Reserve recently signalled that it was ready to start tapering its asset purchases in November and could raise interest rates by the end of 2022. The proposed increase in the corporate tax from the current 21% to our base case of 25% could also generate a modest drag on corporate earnings. China’s increasing regulatory scrutiny could also impact US companies that generate substantial earnings from China. The recent surge in oil prices to record highs of above $80 a barrels could also weigh on companies’ earnings. Furthermore, the possibility of a virus resurgence in the US as well as the rising US-China tension owing to the Aukus pact and the Quad alliance also pose as downside risks. On balance, we are currently neutral on US equities. We note that with the recent rout in shares of technologies companies owing to the rise bond, it could provide selective opportunities to invest in certain sectors. Renewables and the construction sectors may stand to benefit from the Infrastructure bill. However, stock selection remains imperative.

Bonds and Currency: Review and Outlook

Recently, US Treasuries yields reached 0.04% for the 3-month rate, 0.05% for the 6-month rate, 0.28% for the 2-year rate, 1.52% for the 10-year rate and 2.08% for the 30-year rate.

Latest data from the US Bureau of Labour Statistics (BLS) showed that consumer prices eased in August. However, inflation remained strong, as pandemic-related shortages of labour and supplies continued to drive up prices. In August, the US Consumer Price Index (CPI) rose by a seasonally adjusted 0.3% mom, slower than the 0.9% and 0.5% mom increase in June and July respectively. WSJ reported that price growth driven by used vehicles eased in August. The recovery of travel-related prices also reversed as the spread of the Delta variant of the Covid-19 virus depressed demand, particularly for travel. Airline fare prices declined by 9.1% mom in August, while rental cars and trucks dropped by 8.5%. Gasoline prices picked up by 2.8% mom in August, a faster pace than in July. Restaurant prices and grocery prices both rose by 0.4% mom in August, rising at a slightly slower monthly pace than in July. On an annual basis, the CPI rose by an unadjusted 5.3% in August, down from the 5.4% pace in June and July. The so-called core price index, which excludes the often volatile categories of food and energy, climbed by 4% yoy in August, compared with 4.3% in July.

Given the latest developments on inflation, the US Federal Reserve (Fed) has signalled it could start to gradually taper its monthly purchases of US$120 billion in Treasury and mortgage debt in November. Further, the Fed’s rate-setting committee indicated it could raise interest rates next year amid risks of longer-than-anticipated rises in inflation. However, recent remarks by Fed Chairman Jerome Powell suggest that the central bank still expects inflation to be temporary. At a recent House Financial Services Committee hearing, Mr. Powell commented that the surge in price this year “is a function of supply-side bottlenecks over which we have no control.” He also highlighted that the Fed expects high inflation to abate, as it believes the factors that are causing it are temporary and tied to the pandemic and the reopening of the economy. Similarly, the Conference Board forecasts that yoy inflation rates will likely continue to climb through the end of 2021 and into early 2022 due to sizeable base effects. However, it foresees that the intensity of mom price increases may lessen over the coming months.

However, former Treasury Secretary Lawrence Summers believes that rising inflation is a concern. Summers foresees the potential for lasting changes about the interplay between the job market and price pressures as a result of Covid-19. Summers believes that with businesses rethinking their models and people rethinking their lives in light of the pandemic, there is structural change under way. This could mean that the US can’t go back to the pre-Covid era of sub-4% unemployment and a tame rate of inflation, he indicated. “We’re kind of making a bit of a paradigm error” in terms of the read on inflation dynamics, according to Summers.

Below, we highlight salient views by fund managers and financial institutions on US government, Investment Grade (IG) and High Yield (HY) bonds.

US government bonds

Views on US government bonds were mixed. Fidelity has upgraded to being neutral in US government bonds from underweight. Fidelity believes there is far greater uncertainty around the outcome of Fed tapering than assumed and sees a potential source of sharp volatility going forward. While Fed tapering will change demand dynamics in the US Treasuries (UST) market, supply will also see some dramatic shifts. Fidelity expects issuance of US Treasuries in 2022 and onwards will be substantially lower than the levels seen in 2021 due to a sharper fall in the US fiscal deficit despite ongoing budgetary discussions by the US Congress. In aggregate, Fed tapering and lower UST coupons will still see net US Treasury supply shrink by approximately US$500 billion. On balance, Fidelity believes it could be argued that the Fed will still be loosening monetary conditions rather than tightening them from already record loose levels. Further, unlike any previous Fed hiking cycle going all the way back to 1994, in this current episode the Fed will be trying to tighten financial conditions and policy at a time when inflation will be falling. Fidelity noted that more pessimistic observers have forecasted core PCE, the Fed’s preferred measure of inflation, at 1.6% by the end of 2022, well below the Fed’s target. If this comes through, the tightening debate will require a very strong degree of health in both the labour market and overall financial conditions. Overall, Fidelity is broadly neutral US duration, and expects US10Y yields to likely trade in a 1.25% to 1.50% range in the next few months, although with risks skewed towards lower yields ahead.

In contrast, HSBC maintains an underweight in US government bonds, highlighting that following the recent rally, risk to yields are tilted to the upside amid robust global growth expansion, Fed policy normalization and inflation uncertainties. However, a big move in yields is unlikely given the pricing in of inflation risk and global demand.

US IG bonds

Fidelity highlighted that technicals in the US are very supportive of US IG, and corporate fundamentals are equally robust. In combination, Fidelity believes these should warrant a constructive stance on the asset class. However, with spread levels across almost all US IG sectors as expensive as they have ever been, Fidelity favours a more defensive stance across its portfolios. One potential trigger for some weakness is the notable uptick in issuances from US corporates – those front loading to take advantage of very cheap funding costs. Nevertheless, with overall rate curves quite flat, Fidelity expects to see more issuance focusing on the longer end of the curve, where all-in yields are still low. Further, corporates do not seem to mind paying concession to get a larger deal done. If this trend continues, Fidelity believes it should lead to a degree of spread widening and provide opportunities to invest in US IG from its current underweight position. Overall, Fidelity is currently underweight in US IG bonds.

Similarly, HSBC maintains an underweight stance in US IG corporate bonds, highlighting that valuations are relatively unattractive, especially for longer-duration bonds. US IG bonds may come under pressure from any unexpected worsening of corporate fundamentals. On a positive note, US corporate fundamentals are broadly robust amid still-healthy activity growth and policy (fiscal & monetary) remains supportive.

US HY bonds

On US HY, Fidelity maintains a neutral stance despite market consensus among investors generally moving defensive towards the asset class, on the back of valuations. This is particularly in the sectors more highly correlated to the economic recovery, such as energy, travel, leisure and gaming, where market sentiment deteriorated as doubts around growth and recovery names came to the fore. Meanwhile, supply has been abundant, and despite a marginal decline over the summer, Fidelity believes it is still on track for a record year, with the current run rate at US$345-350 billion YTD and a full-year estimate of US$500 billion of new issues. Fidelity also noted the high number of lower rated issuers, the number of debt issuers that have come to market, and the low coupons offered, as companies try to lock in very low funding costs.

In contrast, HSBC remains underweight in US HY, highlighting that spreads are at levels consistent with an underweight view. However, while there are uncertainties on the default outlook, the US economy is performing well amid strong policy support.

US Dollar (USD)

Over the past 2 months, the US Dollar Index (DXY) rose by 2.28% to 94.23 from a level of 92.13. Financial institutions including BOS, DBS and UOB are positive on the US Dollar (USD).

BOS highlighted that there are two factors behind recent USD strength. First, the Fed is moving gradually towards monetary policy normalisation. Monetary policy is diverging, with wider interest rate differentials in favour of the US playing a role in supporting the USD. Second, a bigger factor behind recent USD strength has been rising global growth concerns caused by the spread of the Delta variant, which fuelled safe haven demand for the greenback.

DBS expects the USD to extend its rise into Q1 2022. Firstly, according to Commodity Futures Trading Commission (CFTC), net long USD positions increased to pre-Covid levels. Conversely, speculators have unwound their long positions in the DXY’s components, namely the EUR, GBP and CAD. Secondly, the USD is also supported by a weaker global economic outlook for the second half of the year. The World Trade Organization warned that the worldwide trade recovery from the first Covid-19 outbreak might be peaking from fading base effects. More importantly, new export orders have slowed amidst production disruptions from the new Delta-variant and the worldwide shortages of semiconductors. DBS’s forecasts that USDSGD to be 1.38 in 4Q21 and 1.39 in 1Q22.

UOB maintains its prevailing view that the USD will continue to strengthen against both the Majors and Asian currencies as the FED embarks on tapering of asset purchases. Specifically, UOB continue to see USDSGD rising to 1.38 by end of this year, followed by 1.39 by mid-2022. The USD Index (DXY) is forecast to rise to 94.0 by end of this year and subsequently 94.90 by mid-2022.

Summary

In summary, we believe recent economic indicators suggest that the economic recovery has moderated. The US economy expanded for four consecutive quarters, with annualised GDP growth at 6.6% in Q2 2021. However, most financial institutions have revised their full year forecasts downward and projected annual growth between 5.7% and 6.8% in 2021. Consumer spending rebounded moderately by 0.8% mom in August, while consumer sentiment also improved slightly in September, as reflected by an increase in the University of Michigan consumer sentiment index to 72.8 in September from 70.3 in August. However, factors such as high inflation are weighing on consumer optimism. In August, consumers cut their spending on long-lasting goods like vehicles, likely reflecting low inventories and high prices. Retail sales also rose marginally by 0.7% mom in August. Despite the latest jobs report showing that US hiring slowed in August, unemployment rates fell to a pandemic low of 5.2% in August. US manufacturing continued to recover as the manufacturing Purchasing Managers’ Index (PMI) increased to 59.9% in August. However, the manufacturing sector is still getting held back by supply chain bottlenecks and shortages of key components and raw materials. The housing market remained strong driven by the low interest rates as the 30-year fixed mortgage rate fell to 2.84% in August from 2.87% in July and lower than the average rate of 3.11% in 2020. Additional stimulus from the Bipartisan Infrastructure Bill could also provide a boost to jobs and economic growth. However, there is a possibility that the Infrastructure Bill might be held back until the larger education, healthcare and climate package (US$ 3.5 trillion bill) has passed the Senate. Barring a significant deterioration in the virus situation and/or stimulus disappointment, we are neutral on US economic outlook.

On the stock market, strong expectations for corporate earnings growth will continue to be the main driver of the equities rally. Major financial institutions are forecasting 2021 S&P 500 earnings per share to reach US$207, representing a strong 45% yoy growth. Consequently, 2021 S&P 500 targets have been upgraded. Another positive factor would be additional fiscal stimulus. We believe the Bipartisan Infrastructure Bill could benefit certain sectors due to increase in spending on infrastructure projects and other green sectors (electric vehicles and renewables). However, there are also downside risks which include sooner-than-expected tightening of Fed policies, a potential increase in the US corporate tax rate, increased regulatory scrutiny in China, surging oil prices, the possibility of renewed lockdowns in the US, and rising US-China tensions. On balance, we are currently neutral on US equities. We note that with the recent rout in shares of technologies companies owing to the rise in bond yields, it could provide selective opportunities to invest in certain sectors like Renewables and the construction sectors. However, stock selection remains imperative.

On the bond market, the 10-year US Treasury yield recently topped 1.5% for the first time since June, lifted by the prospect of tighter monetary policy. Business reopening and falling coronavirus cases have boosted investors’ optimism about the U.S. economy and helped spur the recent yield gains. Core PCE inflation, the Fed’s preferred measure of inflation remianed unchanged at 3.6% yoy in July from June. The Consumer Price Index (CPI) rose by 5.3% in August compared to the 5.4% gain in July. Recently, the Federal Reserve signalled that it could start scaling back its easy money policies by tapering its monthly US$120 billion asset purchases as early as November this year. Further, new projections released at the end of the FOMC meeting showed half of 18 officials expect to raise interest rates by the end of 2022. If the Fed would maintain its hawkish stance after its meeting on 2-3 November, US 10-year Treasury bond yields could continue to rise and could reach its March high of 1.778%. Against this backdrop, we are currently negative on the government bond market outlook. However, if the Covid-19 situation were to worsen, it could slow the economic growth, keeping the inflation rate low. Hence, there is a possibility that Fed may not taper the interest rate by the end of 2022, keeping the interest rate low, posing a downside risk to our outlook.

On the currency market, the USD has appreciated over the past 2 months as reflected by a 2.28% increase in the DXY. Recent rising bond yields have increased USD attractiveness. The Fed recently announced that it would start tapering its asset purchases in November and may raise interest rate by end of 2022. However, if inflation concerns were to persist, there is a possibility that Fed may raise interest rates earlier than previously expected, which may support USD attractiveness. Against this backdrop, we are currently positive on USD.

Disclaimer: This publication is for information and general circulation only. It does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. Data from third party sources may have been used in the preparation of this material and FPA Financial Corporation Pte Ltd (“FPA”) has not independently verified, validated or audited such data. Where lawfully permitted, FPA does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may be subject to change without notice. Investment involves risk. You should seek advice from a financial adviser before investing in the above-mentioned asset class. If you choose not to seek advice from a financial adviser, you should consider whether the asset class in question is suitable for you. Views expressed are subject to change, and this publication cannot be construed as an advice or recommendation. This advertisement has not been reviewed by the Monetary Authority of Singapore.