Our latest views on the Eurozone economy and stock markets

By FPA Investment Team | 6 December 2021

Eurozone economy: Review and Outlook

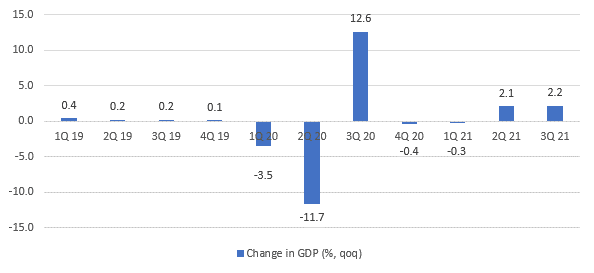

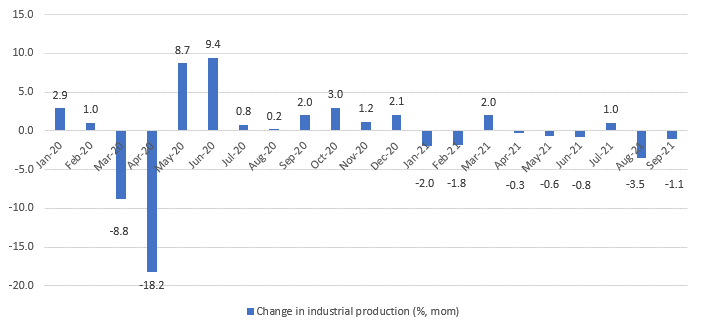

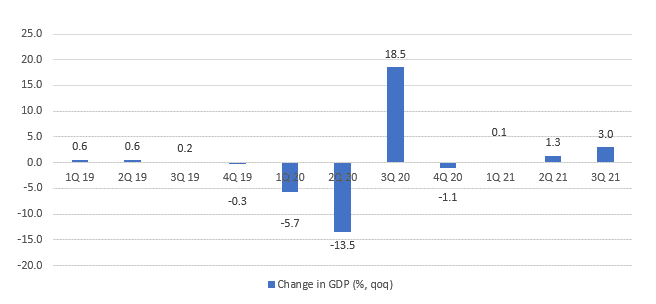

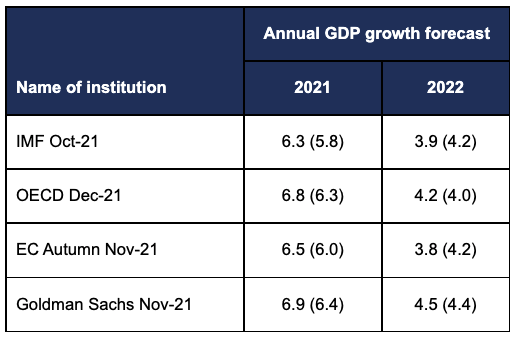

Eurozone economy grew by 2.2% in the third quarter

The Eurozone’s gross domestic product (GDP) grew by 2.2% qoq in Q3 2021, as shown in Exhibit 1. This followed a 2.1% quarterly growth in the previous quarter. During the quarter, France and Italy were the top performers of the larger eurozone economies, while Germany and Spain lagged behind (We will discuss the German, French and Italian economies in more details below).

Exhibit 1: Eurozone quarterly GDP growth

Source: Eurostat

The European Commission (EC) has warned that supply chain bottlenecks and rising energy costs threaten to constrain the EU’s recovery from the pandemic despite a recent pick-up in growth. Economic growth in the EU and Euro area would reach 5% in 2021, quicker than the 4.8% pace it previously expected. However, it warned of “mounting headwinds” as a result of logistics logjams, strained supply chains and shortages of raw materials, which are hitting Germany and other manufacturing centres. EC is also concerned that an acceleration in Covid-19 cases could mar the EU’s economic prospects, especially in countries where vaccination rates are low. The balance of risks to growth had “tilted to the downside”, the commission warned. Paolo Gentiloni, the EU’s economics commissioner highlighted three key threats to this positive picture: a marked increase in Covid cases, most acute in areas where vaccinations are relatively low; rising inflation, driven largely by a spike in energy prices; and supply chain disruptions that are weighing on numerous sectors. Nevertheless, EC highlighted that the overall growth outlook should remain strong, with Eurozone forecast to sustain a 4.3% expansion in 2022. Latest forecasts by EC show that Germany’s economy is predicted to grow by 2.7% in 2021, slower than the overall EU rate, before it accelerates to 4.6% in 2022. France is projected to expand by 6.5% in 2021 and 3.8% in 2022, while Italy will grow 6.2% in 2021 and 4.3% in 2022.

The OECD highlighted that after a strong rebound in 2021 with GDP growth of 5.2%, as confinement measures were gradually lifted, economic activity in the Eurozone is projected to expand by 4.3% in 2022. Growth will be supported by strong consumption, with households reducing their saving rate, and higher investments owing in part to national and European recovery plans. Unemployment is projected to decline to close to pre-crisis levels. With the rapid reopening of the economy, supply chain bottlenecks and the rebound in energy prices are pushing up inflation. Although inflation dynamics vary across the Eurozone, OECD highlighted that this is not expected to last, with inflation returning to levels below the European Central Bank (ECB) objective by the end of 2022. Monetary policy is set to remain largely accommodative even if the exceptional level of accommodation through the Pandemic Emergency Purchase Programme (PEPP) is expected to be gradually reduced. Likewise, while exceptional emergency fiscal measures are being reduced, the swift and effective implementation of recovery plans should support activity and potential growth by facilitating the sectoral reallocation towards a more digital and greener economy.

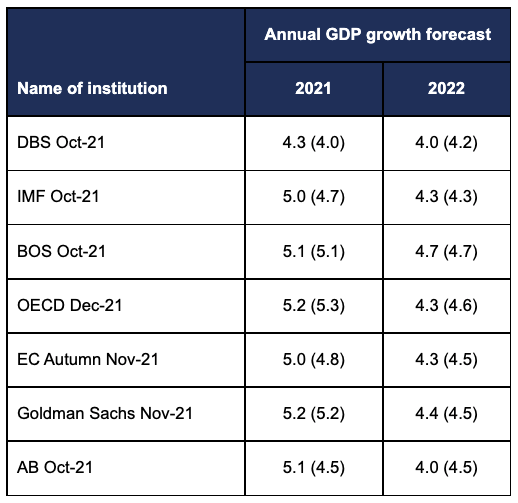

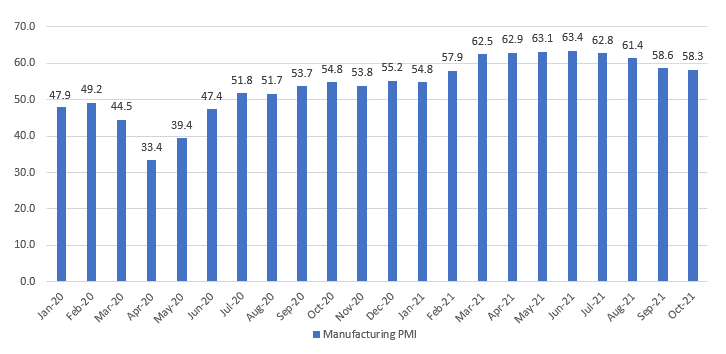

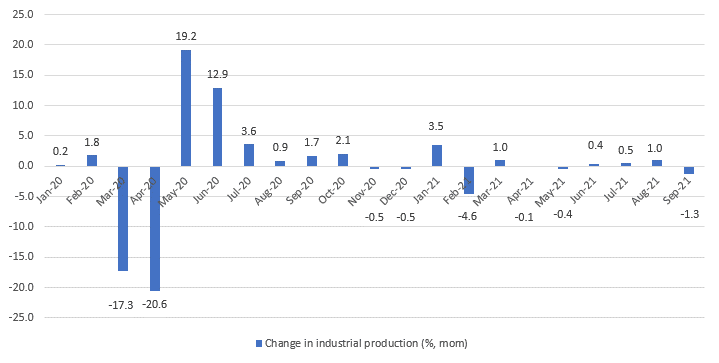

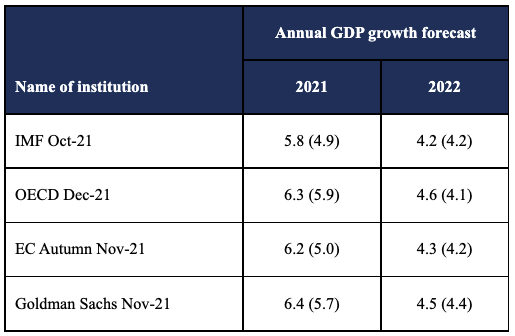

The GDP growth forecasts by various financial institutions and fund managers for the Eurozone are shown in Exhibit 2.

Exhibit 2: Eurozone GDP growth forecasts for 2021 and 2022

Source: respective financial institutions and fund managers

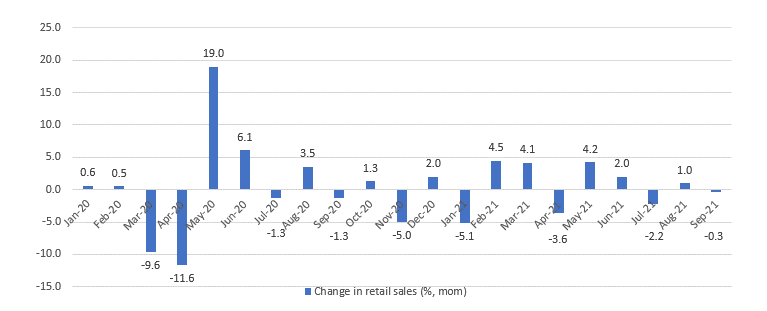

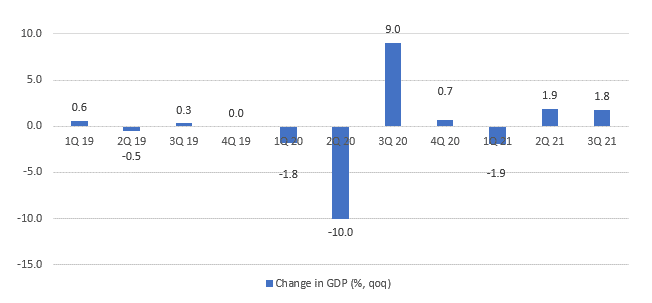

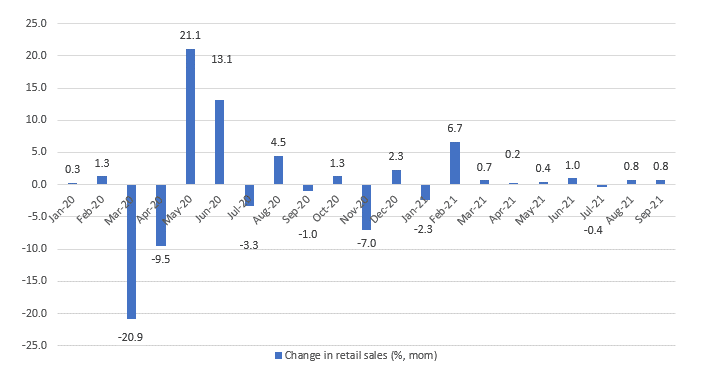

Retail sales declined in September

According to Eurostat, Eurozone retail sales fell by 0.3% mom in September, but were up by 2.5% from a year ago, as shown in Exhibit 3.

Exhibit 3: Eurozone monthly change in retail sales

Source: Eurostat

In September, car fuel sales rose by 1.0% from the previous month, while food, drinks and tobacco sales rose by 0.7%. However, non-food sales dropped by 1.5%, including a 1.4% decline in Internet and mail order sales. Germany recorded the largest 2.5% drop in retail sales. In the coming months, with soaring energy prices, rising coronavirus infections and supply chain bottlenecks, consumers may become even more cautious. High petrol prices could also curb household purchasing power, leaving families with less to spend on other goods.

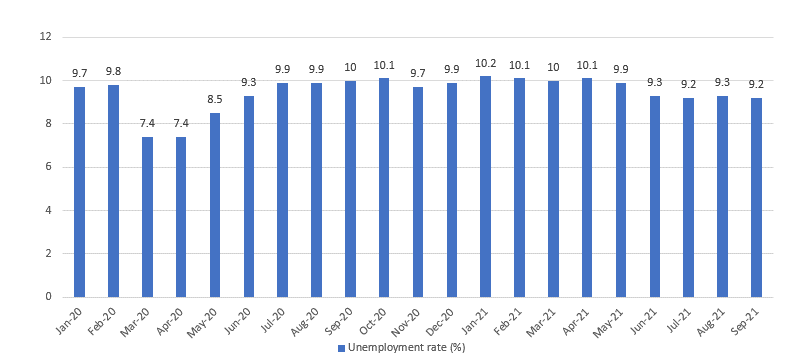

Unemployment situation improved in September

Latest data released by Eurostat showed that Eurozone’s unemployment rate fell to 7.4% in September from 7.5% in August, as shown in Exhibit 4.

Exhibit 4: Eurozone monthly unemployment rate

Source: Eurostat

The number of people classified as unemployed in the Eurozone decreased by 255,000 from August to 12.08 million in September. Compared to a year ago, the number of unemployed persons fell by 1.92 million in September. There were 2.307 million young persons (under 25) unemployed in the Eurozone in September, which corresponds to a youth unemployment rate of 16.0%, down from 16.3% in August.

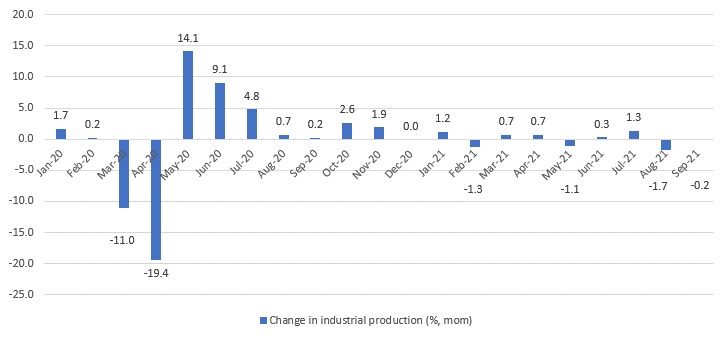

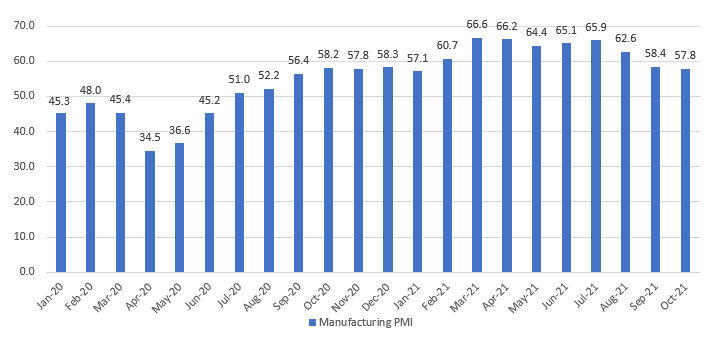

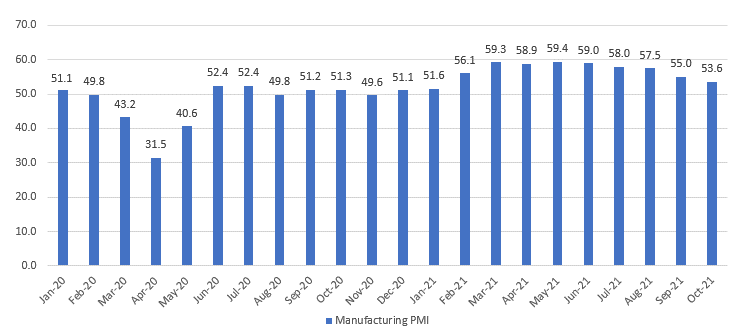

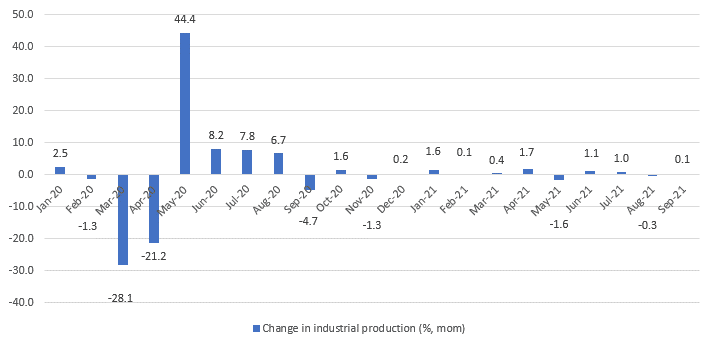

Industrial production weakened in September

Industrial production in the Eurozone declined by 0.2% mom in September, according to Eurostat. This was the second consecutive monthly decline as delays in input deliveries stemming from global supply-chain strains held back manufacturing activity. In August, industrial output fell by a revised 1.7% mom from a previously estimated drop of 1.6%. The summarised monthly change in Eurozone industrial production is shown in Exhibit 5.

Exhibit 5: Eurozone monthly change in industrial production

Source: Eurostat

Compared to a year ago, industrial production rose by 5.2% in September, but stayed below pre-pandemic levels. Supply-chain disruptions due to semiconductor shortages are weighing heavily on the Eurozone’s automotive sector, but companies from other industries are also struggling to obtain a wide variety of inputs and components. These supply-related strains are constraining production, denting order books and increasing costs, according to recent surveys. Current supply-chain problems are expected to extend into 2022.

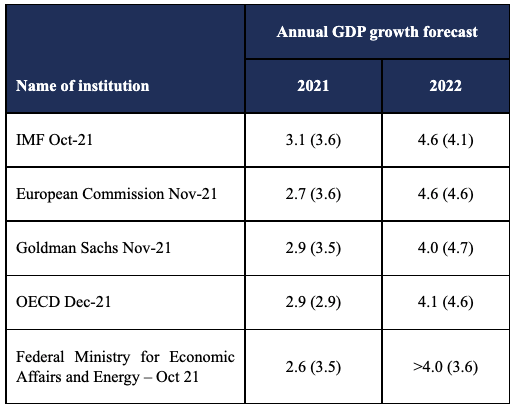

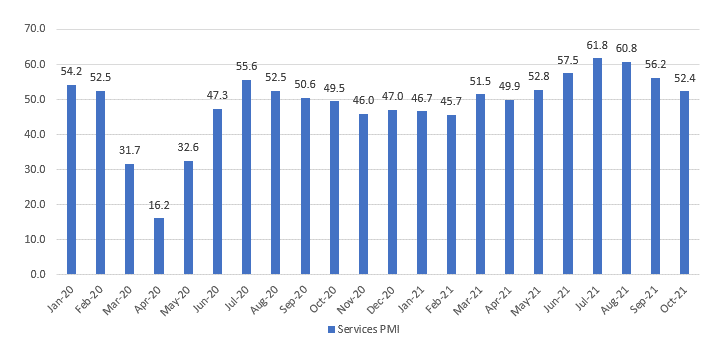

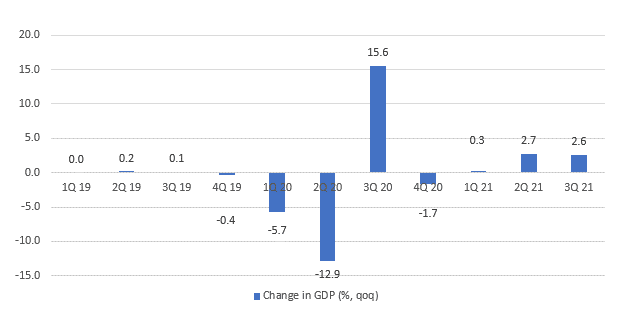

Manufacturing and services PMI indicators fell in October

According to IHS Markit, the final manufacturing Purchasing Managers’ Index (PMI) for the Eurozone dipped to an eight-month low of 58.3 in October, from September’s 58.6, as shown in Exhibit 6. This was lower than the initial flash estimate of 58.5, but still above the 50-mark separating growth from contraction.

Exhibit 6: Eurozone monthly manufacturing PMI

Source: IHS Markit

In October, supply-chain issues and rising inflation affected French, German and Spanish industrial production, but Italian manufacturing recorded healthy expansion, growing at its strongest rate since June. Those shortages meant suppliers were able to jack up their charges – the input prices index for the Eurozone climbed to 89.5 from 86.9, the highest since the survey began in mid-1997.

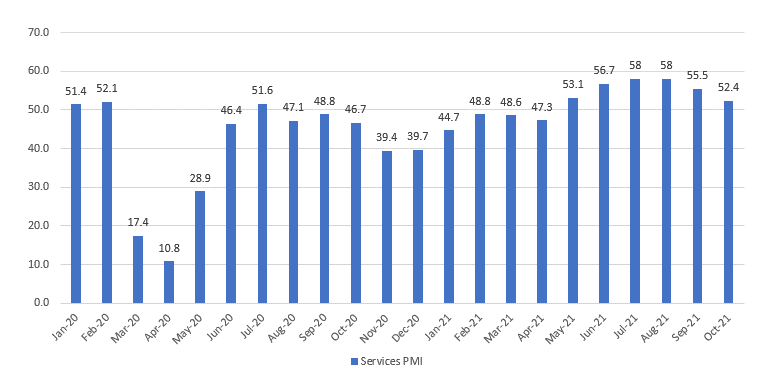

Meanwhile, recent data from IHS Markit also showed that Eurozone’s services PMI index fell to a 6-month low of 54.6 in October from 56.4 in September, as shown in Exhibit 7. The reading fell below a preliminary estimate of 54.7 but remained above the 50 mark separating growth from contraction.

Exhibit 7: Eurozone monthly services PMI

Source: IHS Markit

Services activity fell in October as supply chain bottlenecks and logistical issues related to the Covid-19 pandemic pushed input prices to rise at the fastest rate in over 2 decades. As demand weakened, the new business index dropped to 55.1 in October from 55.3 in September. Supply chain bottlenecks have caused the costs of raw materials to soar and the composite input prices index climbed to 73.2 from 70.9, the highest since the survey began in mid-1998. The supply constraints meant growth slowed in Germany for a third month. It was a similar picture in France, Spain and Italy.

Fiscal stimulus to support the recovery

The European Union (EU) has provided a stimulus package worth EUR2.018 trillion. This comprises of the EU’s long-term budget (known as the Multiannual Financial Framework 2021-2027 (MFF)) amounting to EUR1.21 trillion and the NextGenerationEU (NGEU) of EUR806.9 billion, which is a temporary instrument to power the recovery. The breakdown of the MFF and NGEU is summarised in Exhibit 8.

Exhibit 8: Breakdown of the MFF and NGEU

Source: Eurostat

The following table in Exhibit 9 provides a more detailed breakdown of the NGEU.

Exhibit 9: Detailed breakdown of the NGEU

Source: Eurostat

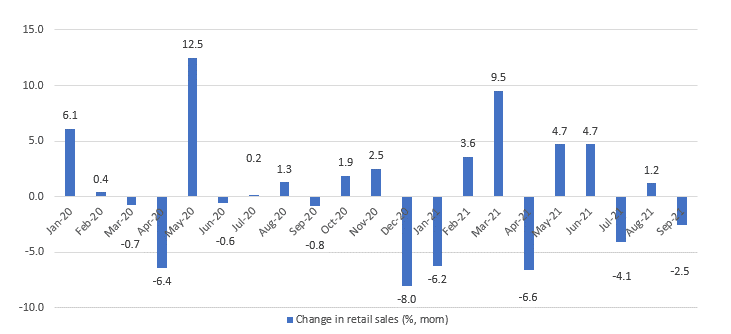

Trade surplus narrowed in September

According to Eurostat., the Eurozone’s trade surplus in goods stood at EUR7.3 billion in September, down from the EUR24.1 billion registered a year ago. The reading missed economists’ forecasts, who expected trade surplus to come in at EUR8.9 billion, according to a FactSet poll. The surplus declined as a 21.6% yoy increase in imports to EUR202.0 billion outpaced the 10.0% yoy rise in exports to EUR209.3 billion. On a mom basis in September, exports decreased by 0.4%, while imports increased by 1.5%. Adjusted for seasonal swings, the trade surplus was EUR6.1 billion in September compared with EUR9.7 billion in August.

i. Germany

Germany’s GDP grew by 1.7% in Q3 2021

According to latest data released by the Federal Statistics Office, the German economy expanded by 1.7% q-o-q in Q3 2021. Growth in the second quarter was revised up to 1.9% from 1.6%. The summarised data for quarterly GDP growth is shown in Exhibit 10.

Exhibit 10: Germany’s quarterly GDP growth

Source: Federal Statistics Office

Supply shortages are preventing some German manufacturers with full order books from producing at full capacity, and rising energy prices are driving up consumer prices. This has raised concerns of weak growth as winter approaches. The Deutsche Bundesbank (Bundesbank) foresees that German economic growth is likely to slow sharply in Q4 2021 as industry continues to suffer from supply shortages and demand for services wanes. Unexpected supply-chain bottlenecks are now holding back Germany’s vast car manufacturing sector, while higher energy costs and persistent concerns over the coronavirus pandemic could hit consumer sentiment. “Growth is likely to slow significantly in the current quarter,” the Bundesbank said, adding that full-year growth is now likely to be “significantly” below its 3.7% prediction made in June. The central bank highlighted that strong momentum in the service sector is likely to subside considerably, while the manufacturing sector is likely to continue to suffer from delivery problems.

Similarly, the German government expects growth in 2021 to be significantly weaker than predicted, and lowered its 2021 GDP growth forecast to 2.6% from an earlier prediction of 3.5%. Economy Minister Peter Altmaier said the cut in the 2021 outlook reflects a scarcity in some raw materials and rising energy prices, particularly for gas. The government expects a “boom” to take effect only in 2022, and raised its forecast for 2022 GDP growth to above 4% from 3.6%. “The precondition is that we stabilize international supply chains, and, for example, make sure that more of the chips that are built into almost every device, especially cars, are produced,” according to Altmaier.

Latest data from the OECD’s recently released economic outlook report show that Germany’s economy is projected to grow by 2.9% in 2021 and 4.1% in 2022. OECD highlighted that Germany’s recovery is being hampered by shortages of key manufacturing inputs, although a large stock of unfilled orders signals a strong potential rebound as supply constraints ease. Private consumption will accelerate in 2022 as confidence improves. Solid investment will be underpinned by low interest rates and increasing capacity pressures. However, the rise in COVID-19 cases and persistent supply shortages in critical industries could slow the recovery. Fiscal policy will gradually become less supportive, even though public investment is set to grow and could play a bigger role if delivery constraints can be overcome.

The summarised GDP growth forecasts by various financial institutions for Germany are shown in Exhibit 11.

Exhibit 11: Germany’s GDP growth forecasts for 2021 and 2022

Source: respective financial institutions

Retail sales declined in September

According to the Federal Statistics Office, Germany’s retail sales fell by 2.5% m-o-m in September, following a 1.2% monthly gain in August, as shown in Exhibit 12. On a y-o-y basis, retail sales were up by 0.9% in September, but up 3.7% compared to February 2020 pre-pandemic levels.

Exhibit 12: Germany’s monthly change in retail sales

Source: Federal Statistics Office

However, a Gfk survey showed that German consumer sentiment improved in November despite rising inflation. The GfK institute said its consumer sentiment index, based on a survey of around 2,000 Germans, rose to 0.9 points for November, from a revised 0.4 points a month earlier. Still, the institute warned that the good feelings were unlikely to last if prices continued to climb, a trend that would also delay a fundamental recovery in consumer sentiment. While the propensity to buy rose slightly, both economic and income expectations were on the decline.

Unemployment moderated in September

German unemployment fell more than expected in October, suggesting that companies were firmly on a post-pandemic hiring spree despite supply bottlenecks that have hurt manufacturers. According to the Labour Office, the number of people out of work fell by 39,000 in seasonally-adjusted terms to 2.466 million. The seasonally-adjusted jobless rate dropped to 5.4%. However, Federal Labour Agency chief Detlef Scheele said despite the improvement, “the numbers remain significantly lower that before the pandemic and we are facing big challenges.”

Industrial production fell in September

According to the Federal Statistics Office, German industrial output fell by 1.1% mom in September after an upwardly revised drop of 3.5% in August, as shown in Exhibit 13.

Exhibit 13: Germany’s monthly change in industrial production

Source: Federal Statistics Office

The fall in September was driven by a drop in the production in the mechanical engineering, electrical equipment and data processing equipment sectors, the ministry said. “Supply bottlenecks for raw materials and intermediate products that have been going on for a long time are being reflected on a broader front,” said the ministry. Compared with the previous quarter, production in the manufacturing sector fell by 2.4% in Q3 and is currently 9.5% lower than in February 2020.

PMI data declined in October

According to IHS Markit, German manufacturing sentiment weakened in October, with the Germany’s PMI fell to 57.8 in October from 58.4 in September, as shown in Exhibit 14.

Exhibit 14: Germany’s monthly manufacturing PMI

Source: IHS Markit

IHS Markit said that output levels across the manufacturing sector are being increasingly shackled by supply bottlenecks. According to surveyed businesses, the well-documented slowdown in autos production is dragging down other parts of the manufacturing economy with it, as firms in that sector scale back orders for components and materials. “However, while producers of intermediate goods have recorded a sustained drop in new orders, we’re still seeing some pockets of robust strength in demand, particularly for investment goods,” said IHS Markit. Backlogs continued to rise across each of the main industrial groupings, suggesting this is still mainly a supply-side issue. Worryingly, the supply problems took a turn for the worse in October, with lead times on purchases lengthening to the greatest extent for three months. Adding to this, the rate of cost inflation has crept back up towards the record highs seen in the summer, leading to an unprecedented rise in factory gate prices and putting more inflationary pressure into the system. Manufacturers lost further confidence that these issues will be resolved sooner rather than later, with business expectations now at their lowest since August 2020.

Meanwhile, growth in business activity also slowed in Germany for a third consecutive month in October, as supply bottlenecks and higher energy costs pushed inflation in Europe’s largest economy to a record high. IHS Markit’s final PMI for services showed activity in the sector dropped to a six-month low at 52.4 in October from 56.2 in the previous month, as shown in Exhibit 15.

Exhibit 15: Germany’s monthly services PMI

Source: IHS Markit

The composite PMI index, comprising both the services and manufacturing sectors, fell to 52.0 from 55.5 in September. The figures suggest the economy is likely to lose further momentum in the final three months of the year, according to IHS Markit. In addition to supply problems, service providers reported staffing capacity constraints which were also holding back activity, though overall job creation remained robust in the sector. Price pressures intensified further in the services sector, propelled by a jump in energy costs. “Goods inflation continues to run well ahead of that of services prices, but the latter is nevertheless now at a record high as firms in the sector pass on a multitude of increasing costs to customers,” IHS Markit said.

Business confidence weakened in October

German business confidence was negatively impacted in October as global supply logjams damp momentum in the manufacturing-heavy economy. A gauge compiled by the Munich-based Ifo Institute dropped for a fourth time in a row and more than economists predicted. At 97.7 in October, the Ifo Business Climate Index was down from 98.9 in September, and the lowest level in six months, as shown in Exhibit 16.

Exhibit 16: Germany’s monthly Ifo Business Climate Index

Source: Ifo Institute

October’s figures point to the mounting challenges facing German businesses, who are particularly exposed to supply disruptions given the nation’s reliance on industry. Recent company surveys suggest the weakness is also spilling into services as consumers turn wary of quickly rising prices. “Supply problems are giving businesses headaches,” Ifo President Clemens Fuest said. “Capacity utilization in manufacturing is falling,” he added.

Trade surplus narrowed in September

Germany’s seasonally adjusted exports dropped by 0.7% mom to 112.3 billion euros in September, while imports were up by 0.1% mom to 99.2 billion euros. Accordingly, the trade surplus stood at 13.2 billion euros in September, much lower than during the period before the pandemic, when it often exceeded 20 billion euros each month. In terms of specific country markets, German exports to the United Kingdom fell by 10% y-o-y to 5.7 billion euros and imports from Britain dropped by 20% y-o-y to 2.3 billion euros. German exports to China edged down by 0.2% on the year to 8.5 billion euros and exports to the United States jumped by 16.2% on the year, to 10.8 billion euros.

ii. France

France’s GDP grew by 3.0% in Q3 2021

According to INSEE, the French economy grew by 3.0% qoq in Q3 2021, as shown in Exhibit 17. This was faster-than-expected as the Eurozone’s second largest economy was propelled by a pick-up in consumer spending and exports.

Exhibit 17: France’s quarterly GDP growth

Source: INSEE

Finance Minister Bruno Le Maire said the Q3 growth figure was an “exceptional result” that showed the economy was heading in the right direction. INSEE said the third-quarter growth meant France’s economy was close to getting back to its level before the COVID-19 pandemic hit. INSEE has forecast the French economy to grow 6.25% for 2021.

According to a Bank of France’s survey of businesses, French economic activity reached a level in August not seen since before the Covid-19 pandemic and has continued rising since, aided by a strong recovery in the service sector. Economic output was about 0.5% above early 2020 levels in October and will rise again in November, putting the Euro area’s second-largest economy on track for roughly 0.75% growth in the final quarter of the year, the survey estimates show. “This return to pre-crisis levels has come sooner than we expected previously — we’ve gained about one quarter in time,” the central bank’s chief economist Olivier Garnier said. If the fourth quarter forecast holds up, growth for the year would be around 6.75%, he added.

OECD expects France’s GDP to rebound by 6.8% in 2021 before growth moderates to 4.2% in 2022. Domestic demand will drive the recovery. Improved labour market outcomes will boost private consumption while the recovery and investment plans will support investment. Exports will gradually catch up as prospects in the aeronautic and tourism sectors improve. Headline inflation has reached a high level, but the temporary freeze of regulated energy prices will reduce the short-term impact of wholesale energy price rises, while persistent labour market slack should temporarily limit pressures for wage increases. Fiscal support has become more targeted and should be reduced further as the recovery gains traction.

The summarised GDP growth forecasts by various financial institutions for France are shown in Exhibit 18.

Exhibit 18: France’s GDP growth forecasts for 2021 and 2022

Source: respective financial institutions

Consumer confidence weakened in October

French consumer confidence in October fell back below its long-term average as households fretted about the impact of rising prices on their ability to save in the future. Latest data from INSEE showed that consumer sentiment fell 2 points to 99 in October from 101 in September, as shown in Exhibit 19.

Exhibit 19: France’s monthly consumer sentiment index

Source: INSEE

Spiralling energy prices have led to a pick-up in inflation in Europe. Prime Minister Jean Castex recently announced an EUR100 grant to help lower income families cushion the pain of rising gas, electricity and gasoline prices. Even so, some families say they are cutting back on groceries, refuelling their cars less and using the heating more sparingly to make ends meet. The INSEE data showed a sharp fall in household’s confidence in their ability to save and a more moderate dip in sentiment about their future outlook.

Unemployment rate improved in September

According to INSEE, the number of unemployed people in France (excluding Mayotte) reached 2.4 million in Q2, down by 16,000 over the quarter. The ILO unemployment rate was relatively stable at 8.0% in Q2, as shown in Exhibit 20.

Exhibit 20: France’s monthly ILO unemployment rate

Source: INSEE

In Q2, the unemployment rate was close to the level recorded during end of 2019. Over the quarter, the unemployment rate decreased for people aged 15 to 24 and those aged 25 to 49, but rose for those aged 50 or more.

Industrial production fell in September

France’s industrial production fell in September following three months of gains as growing supply-chain strains weighed on output, particularly in the automobile sector. INSEE data showed that total industrial output decreased by 1.3% mom in September, as shown in Exhibit 21.

Exhibit 21: France’s monthly change in industrial production

Source: INSEE

Compared to February 2020’s pre-pandemic levels, industrial production was down by 5.2% in September. Manufacturing output – the biggest component of industrial production – was down by 1.4% mom in September. Factory output was dragged by a 14.6% fall in automobile production. Energy production fell by 0.7%, while construction output climbed by 2.6%.

PMI indicators were mixed in October

The latest IHS Markit PMI survey showed that supply chain issues hit France’s manufacturing sector in October, where the slowdown in growth came broadly in line with initial forecasts. France’s manufacturing PMI fell to 53.6 in October from 55.0 in September, as shown in Exhibit 22.

Exhibit 22: France’s monthly manufacturing PMI

Source: IHS Markit

IHS Markit senior economist Joe Hayes said supply chain problems could continue to weigh on the sector, adding that manufacturing output had declined in France for the first time since January as a result of problems with supplies of key goods, caused partly by strict COVID-19 controls which have affected ports. “Because firms cannot secure the inputs needed to make their products, orders are now also falling as clients are facing lengthy delays on orders or are unable to get components and other items needed to turn semi-finished goods into finished goods,” said Hayes. He believes that it is difficult to imagine the situation improving any time soon.

Meanwhile, IHS Markit highlighted in a separate report that France’s service sector regained momentum during October with output rising at the fastest rate since July and ending a three-month period of slowing growth. The seasonally adjusted France Services Business Activity Index edged up slightly to 56.6 in October, from 56.2 in September, as shown in Exhibit 23.

Exhibit 23: France’s monthly services PMI

Source: IHS Markit

According to Joe Hayes, Senior Economist at IHS Markit, services output is still rising at a relatively sharp rate by historical standards as activity levels within the economy return to pre-pandemic levels. Demand conditions are still robust, and firms are adding more staff to the payroll. Jobs growth was at its sharpest for over two decades in October, which should facilitate a continuation of the strong growth trend we’ve seen since the summer. However, the recovery is becoming highly dis-jointed as supply issues disrupted goods producers immensely in October. Input costs rose at the fastest pace for over 13 years, keeping output charge inflation at an elevated rate. Hayes believes economic recovery efforts heading into the winter appear to be resting on resilience in the services economy.

iii. Italy

Italy’s GDP grew by 2.6% in Q3 2021

According to ISTAT, the Italian economy grew by 2.6% qoq in Q3 2021 following a 2.7% quarterly growth in the earlier quarter, as shown in Exhibit 24.

Exhibit 24: Italy’s quarterly GDP growth

Source: ISTAT

ISTAT said strong domestic demand and exports both contributed to the quarterly rise in GDP during Q3 2021. Industry and services had both expanded, while agriculture had contracted. Italy’s economy has been picking up speed since the spring, as Prime Minister Mario Draghi’s government has scrapped restrictions on business and movement in response to a decline in coronavirus infections and deaths. Official government forecasts suggest a GDP rebound of 6% in 2021, but Draghi said that in the light of recent data he now expects growth “well above” this rate.

Similarly, OECD expects Italy’s economy to rebound strong in 2021, with GDP projected to grow by 6.3% yoy. Thereafter, growth is predicted to ease progressively in 2022 and 2023, with growth of 4.6% and 2.6% respectively. OECD highlighted that the recovery is expected to benefit from supportive fiscal policy, including investment financed through NGEU funds, and progressively normalising services activity. A gradual rise in employment should support steady consumption growth. The recent increase in headline inflation is expected to moderate, but core inflation is forecast to rise as spare capacity declines and purchasing power increases.

The summarised GDP growth forecasts by various financial institutions for Italy are shown in Exhibit 25.

Exhibit 25: Italy’s GDP growth forecasts for 2021 and 2022

Source: respective financial institutions

Sustained retail sales growth momentum in September

According to ISTAT, Italy’s seasonally adjusted index of retail trade rose by 0.8% mom in September, as shown in Exhibit 26.

Exhibit 26: Italy’s monthly change in retail sales

Source: ISTAT

Value of sales in September were higher than those of pre-pandemic February 2020. On a yoy basis, retail sales increased by 5.3% in September, marking the 7th consecutive month of growth. During the month, all channels of distribution increased when compared with year ago. Large-scale distribution was up 2.8%, small-scale distribution rose by 6.3%, while non-store retail sales grew by 7.6%. Online sales increased by 18.8% yoy in September. For sales of non-food products, all sectors experienced growth besides Furniture, textile items and household furnishing which contracted by 0.7%. The strongest increases were reported for Electric household appliances, audio-video equipment and Other goods.

Unemployment rate moderated in September

According to ISTAT, Italy’s unemployment rate was slightly down at 9.2% in September from 9.3% in August, as shown in Exhibit 27.

Exhibit 27: Italy’s monthly unemployment rate

Source: ISTAT

ISTAT reported that those in work were up 0.4% in Q3 as compared with Q2. In September, the youth unemployment rate, measuring job-seekers between 15 and 24 years old, rose to 29.8% from 28% the month before. Meanwhile, Italy’s overall employment rate rose to 58.3% in September from 58.2% in August. Since February 2020, some 300,000 jobs had been lost, producing a fall in the employment rate of 0.4 percentage points, according to ISTAT.

Industrial production rebounded in September

Latest data from ISTAT showed that industrial production increased by 0.1% mom in September, as shown in Exhibit 28. This compared with a monthly output decline of 0.3% in August.

Exhibit 28: Italy’s monthly change in industrial production

Source: ISTAT

In Q3, industrial output rose by 1% qoq, less than the growth seen in previous quarters, as factory output is being crippled across the Eurozone as widespread supply-chain bottlenecks hinder production. Pantheon Macroeconomics believes Italy’s industry will manage to eke out some output in the fourth quarter as Italian firms seem to be dealing better with ongoing supply issues and rising cost price pressures than other Eurozone economies. However, industrial output growth is predicted to be less than in the second and third quarters.

PMI survey data were mixed in October

Italy’s manufacturing sector recorded another month of rapid growth during October, as reflected by an increase in the seasonally adjusted IHS Markit Italy manufacturing PMI to 61.1 from 59.7 in September, as shown in Exhibit 29. This signalled a 16th consecutive monthly improvement in the health of the sector. Moreover, the latest reading was the highest since June and third-highest on record.

Exhibit 29: Italy’s monthly manufacturing PMI

Source: IHS Markit

IHS Markit highlighted that Italy’s manufacturing sector recorded another stellar performance during October, opening the final quarter of the year with a near record improvement in conditions amid further steep rises in output and new orders. However, supply delays remained severe, adding further to inflationary pressures and capacity constraints. Backlogs of work rose at the quickest pace since the series began 19 years ago, with firms blaming material shortages and a lack of available staff, as well as strong demand. These supply constraints undoubtedly held the sector back in October, with many goods producers noting that they were unable to produce some orders due to missing inputs. This was also reflected in firms’ expectations towards output over the year ahead, with sentiment moderating to a three-month low and concerns of supply disruptions and surging price pressures moved closer to the forefront of company thinking. Nevertheless, IHS Markit highlighted that the sector remains in good stead overall, with the loss of output growth momentum mainly reflecting these issues, whilst sales pipelines remain strong. Still, with demand for inputs rising across the globe, IHS Markit foresees supply constraints could have a more significant impact on the performance of Italy’s manufacturing sector before the end of 2021.

Meanwhile, the headline seasonally adjusted IHS Markit Italy Services PMI Business Activity Index decreased to 52.4 in October from 55.5 in September, as shown in Exhibit 30.

Exhibit 30: Italy’s monthly services PMI

Source: IHS Markit

IHS Markit reported that the Italian service sector lost further growth momentum in October, with business activity rising at the weakest pace in the current six-month sequence amid a slightly slower uplift in new business. Pressure on capacity continued to build, however, with firms citing logistical issues and goods shortages as drivers behind the latest rise in backlogs. The moderation in services growth, combined with a slightly weaker upturn in factory production led to the slowest rate of increase in private sector output for six months, albeit one that was still moderate. Further headwinds came from inflationary pressures, with private sector cost burdens rising at a near record pace as supply disruptions and rising material, fuel and energy costs continued to push prices higher still, especially in the manufacturing sector. IHS Markit highlighted that although the pace of expansion remains above the survey’s long-run average, supply constraints and inflationary pressures show no signs of subsiding. With gains to demand from looser COVID restrictions tapering off, there may be a further slowdown over the coming months, especially in comparison to the rapid growth seen earlier in 2021.

Trade surplus decreased in September

In September, Italy’s exports rose by 10.3% yoy while imports rose by 22.5%. Outgoing flows increased by 15.0% for EU countries and by +5.2% for non- EU countries. Correspondingly, incoming flows rose by 15.7% and 32.5%. As a result, the trade balance in September stood at 2,454 million Euros, comprising 762 million euros for EU countries and 1,692 million euros for non-EU countries.

Eurozone economy summary

In summary, the Eurozone economy grew by 2.2% qoq in Q3, following a 2.1% quarterly expansion in the previous quarter. During the quarter, France and Italy, which recorded qoq GDP growth of 3.0% and 2.6% respectively, were the top performers of the larger Eurozone economies, while Germany lagged with a quarterly growth of 1.8%. Eurozone retail sales declined in September, reflecting weaker consumer spending. Meanwhile, unemployment data has improved in major Eurozone economies like France, Germany and Italy, and the overall figure for the Eurozone fell slightly in September. However, industrial production fell in September, as delays in input deliveries stemming from global supply-chain strains held back manufacturing activity. Industrial output declines were also recorded for France and Germany, though Italy’s manufacturing sector remained resilient and saw a 0.1% mom gain in industrial production in September. Supply chain disruptions continued to negatively affect manufacturing activity, as the IHS Markit manufacturing PMI fell to an eight-month low of 58.3 in October. Business growth was also negatively impacted by supply chain bottlenecks and logistical issues, with the services PMI dropping to a 6-month low of 54.6 in October. Generally, weaker PMI data were also recorded in France, Germany and Italy in October. On the trade front, Eurozone’s trade surplus in goods narrowed to EUR7.3 billion in September as yoy import growth outstripped that of exports.

Overall, it appears that recent economic indicators suggest that the Eurozone’s economic recovery may have slowed. However, there is optimism over the impact of fiscal policy on growth in the coming months. The EU’s long-term budget of EUR1,210.9 billion, coupled with the EUR806.9 billion NextGenerationEU (NGEU) temporary recovery instrument, will amount to a total stimulus package of EUR2.018 trillion, the largest ever introduced. Fiscal handouts to households may provide a boost to consumer spending in the coming months. Then again, rising consumer prices as a result of increasing production costs due to supply shortages could weigh on households’ sentiment, which may offset the impact of fiscal support. In addition, persistent supply chain disruptions could continue to limit production output. As it stands, manufacturing activity in major Eurozone economies like Germany and France have been hindered by supply bottlenecks. In particular, the automobile sectors have been most severely hit due to shortages in semiconductor chips. The recent decline in PMI indicators for the Eurozone also suggest that manufacturing sentiment has weakened. Finally, renewed virus concerns have led to the increased possibility of fresh lockdowns, thereby casting uncertainty over the growth outlook. In terms of growth forecasts, financial institutions expect Germany, France and Italy GDP to increase by 2.6% to 3.1%, 6.3% to 6.9% and 5.8% to 6.4% respectively in 2021. For 2022, these economies are expected to grow by 4.0% to 4.6%, 3.8% to 4.5% and 4.2% to 4.6%. As a whole, the Eurozone is projected to expand by 4.3% to 5.2% in 2021 and 4.0% to 4.7% in 2022. All things considered, we are currently positive on the Eurozone economy. In particular, we prefer France and Italy.

Eurozone equities: Review and Outlook

Over the past 3 months, from 10.09.21 to 30.11.21, the Stoxx Europe 600 index rose by 1.79% to 462.96, the German DAX index fell by 3.27% to 15,100.13, the French CAC 40 index rose by 0.86% to 6,721.16 and the Italian FTSE MIB index rose by 0.50% to 25,814.34. Strong Q3 corporate earnings, fiscal stimulus, attractive valuations and a dovish ECB supported the stock markets. However, the discovery of the Omicron variant has sparked concerns over a potential economic slowdown, which has led to a recent correction in the stock markets. Below, we discuss the outlook for the Eurozone equities, taking into account positive factors which could drive the stock markets higher, as well as risk factors that could limit upside.

Strong earnings expectations

Robust Q3 corporate earnings have been a key driver of the Eurozone stock markets. As of 30.11.21, 291 companies in the Stoxx 600 index have reported earnings to date for Q3, according to Refinitiv data. Of these, 63.2% reported results exceeding analyst estimates. Refinitiv estimates suggest that Q3 earnings are expected to increase by 58.6% yoy. Looking ahead, we note that Goldman Sachs retains a positive outlook on European stocks for 2022 and foresees a combination of low interest rates, resilient earnings recovery and cheap valuations to drive a total return of 13% for the Stoxx 600 index in 2022. The bank highlighted that European earnings have been resilient to rising inflation and supply chain problems, and has forecast Stoxx 600 earnings per share (EPS) to rise by 6% in 2022 from this year’s over 60% boom. Recent forecasts by UBS are more optimistic, suggesting a 15% EPS growth for the Stoxx 600 in 2022. UBS continues to expect Eurozone equities to outperform in the coming months given the region’s strong exposure to cyclicals which should benefit from the ongoing economic recovery and rising inflation expectation. Meanwhile, Morgan Stanley expects 10% EPS growth for the MSCI Europe in 2022. We have summarised the EPS forecasts by various financial institutions in Exhibit 31.

Exhibit 31: EPS forecasts for Stoxx 600 and MSCI Europe

Source: Bloomberg

On index targets, the Stoxx 600 index is predicted to reach 506 by the end of 2022, according to the average of 17 forecasts in a recent Bloomberg survey. In particular, JPMorgan and Goldman Sachs were more bullish with a target of 525 and 530 respectively. Their targets correspond to an upside of 15% and 16% respectively, based on the index level of 456.53 as at 30.11.21.

Attractive stock valuations

In terms of valuation, Eurozone equities, as represented by the MSCI EMU index, were recently trading on a forward PE multiple of 15.83x and PB multiple of 1.98x. The MSCI EMU’s dividend yield was recently at 2.14%, which is in excess of European government bond yields. Recently, the German, French and Italian 10-year government bond yields reached -0.349%, 0.022% and 0.969% respectively. Thus, Eurozone equities look attractive from an earnings/bond yield perspective. Further, there is still room for dividends to grow, given strong earnings momentum and the reinstatement of dividends after they were suspended in 2020.

We note that German, French and Italian equities are currently trading at attractive valuations. The MSCI Germany, MSCI France and MSCI Italy are trading at a forward PE of 13.78x, 16.19x and 11.70x respectively, below their long-term averages. Recently, the forward earnings yield of the MSCI Germany, MSCI France and MSCI Italy stood at 7.26%, 6.18% and 8.55% respectively, which are higher than the respective 10-year bond yields for these markets. Further, we also note that the dividend yield on the MSCI Germany, MSCI France and MSCI Italy of 2.28%, 2.17% and 2.91% respectively are also above the 10-year bond yields of the respective markets. Meanwhile, recent Bloomberg data as summarised in Exhibit 32 also suggest that stocks represented by the German DAX index, French CAC 40 index and Italian FTSE MIB index are trading at relatively attractive valuations.

Exhibit 32: Valuation indicators for Eurozone stock indices

Source: Bloomberg

We note that financial institutions like Janus Henderson, Goldman Sachs and Morgan Stanley also believe that European equities are attractive on valuation terms. Janus Henderson highlighted that Eurozone equities are weighted toward cyclical sectors and trade at a discount relative to peers in develop markets. Goldman Sachs believes that despite record returns, Europe equity now looks cheaper than at the outset of 2021 and represents good value versus the US and excellent value versus other assets. In particular, Goldman Sachs highlighted that European equities trade at a steep discount to the US market. Similarly, Morgan Stanley believes that European valuations look reasonable in absolute terms, and very attractive in relative terms. In particular, European stocks have never been this cheap compared to the US market, according to the investment bank. It’s strategists also highlighted that European equities trade at a record low valuation versus real bund yields, with the gap between 10-year real bund yields and Europe’s forward dividend yield at 500 basis points.

Risk factors

While we are positive on the Eurozone stock markets, we would like to highlight certain risk factors. The first is a virus-induced economic slowdown. Over the last week, Eurozone stocks have corrected due to concerns over the potential of an economic slowdown as a result of the spread of the Omicron variant. The World Health Organisation (WHO) has labelled the new virus strain as a “variant of concern’ and early clinical reviews suggest that it could be more infectious than the Delta variant. Countries in the Eurozone are ramping up their response by imposing stricter restrictions on the unvaccinated, curbing travel, and with some having to introduce fresh lockdowns. The virus uncertainty is expected to weigh on the stock markets, and we foresee ongoing volatility in the coming weeks.

Second, inflation risks. Over the past few months, strong Eurozone inflation data have triggered a rise in bond yields, despite the ECB’s efforts to reassure investors that price pressures are only temporary. Latest preliminary data by Eurostat showed that Eurozone inflation reached a record high in November, with prices rising at an annual rate of 4.9% during the month. Official data also showed that inflation in France, Germany and Italy was up by 3.4%, 5.2% and 3.8% on a yoy basis in November. Mounting concerns over record-high inflation across Eurozone economies have weighed on the stock markets and capped gains. However, ECB President Christine Lagarde reiterated that the central bank expects inflation to be transitory and pushed back expectations of a rate hike in 2022. In addition, recent lockdowns in Europe could lead to an economic slowdown, which we foresee should further support the case that the ECB would not raise interest rates so soon.

Third, geopolitical risks. Ongoing US-China tensions are expected to continue to weigh on equities sentiment. At the top of mind, Cross-Strait relations remain tense amid news reports about China’s air incursions by fighter jets, bombers and warplanes into Taiwan. This is also deepening tensions between US and China, as US Secretary of State Antony Blinken recently commented that Chinese leaders should think carefully about their actions toward Taiwan, warning of “terrible consequences” if China precipitates a crisis across the Taiwan Strait. Another key concern would be the threat of Russia’s invasion into Ukraine. The Washington Post recently reported that Russia has been moving troops toward the border with Ukraine while demanding the US guarantee that Ukraine will not join NATO and that the alliance will refrain from certain military activities in and around Ukrainian territory. According to the report, US officials have highlighted the risk that Russia is planning a massive military offence as soon as early 2022. Responding to the situation, the US has urged Russia to pull back its troops from the Ukrainian border, warning that an invasion would provoke harder sanctions on Russia by the US, according to a recent Reuters report.

Eurozone stock market summary

In summary, we note a mixed performance for Eurozone equites over the last 3 months. Upside was supported by strong Q3 corporate earnings, supportive fiscal & monetary policies and attractive valuations, but virus concerns about the Omicron variant have triggered a recent correction in the stock markets. In the coming months, Eurozone equities remain supported by a strong corporate earnings outlook, amid supportive fiscal and monetary policies. Profit margins are also at a record high. Meanwhile, another key selling point of Eurozone equities is attractive valuations. German, French and Italian stocks as represented by the respective MSCI indices are trading at attractive valuations. The MSCI Germany, MSCI France and MSCI Italy are trading at a forward PE of 13.78x, 16.19x and 11.70x respectively, below long-term averages. Further, the forward earnings yield for these indices are also in excess of the French, German and Italian 10-year government bond yields, suggesting attractiveness from an earnings/bond yield perspective. German, French and Italian stocks are also trading at attractive dividend yields which are above the respective 10-year bond yields for these markers. However, there are potential concerns. A key risk would be a virus-induced economic slowdown, which could derail the upbeat momentum in corporate earnings. Strong inflation is also concern as corporate margins may be negatively impacted and rising bond yields could reduce risk appetite. Meanwhile, geopolitical risks relating to increased US-China tensions, tense Cross-Strait relations and the risk of Russian invasion into Ukraine also weigh on investors’ sentiment. All things considered, we remain positive on Eurozone equities.

Disclaimer: This publication is for information and general circulation only. It does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. Data from third party sources may have been used in the preparation of this material and FPA Financial Corporation Pte Ltd (“FPA”) has not independently verified, validated or audited such data. Where lawfully permitted, FPA does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may be subject to change without notice. Investment involves risk. You should seek advice from a financial adviser before investing in the above-mentioned asset class. If you choose not to seek advice from a financial adviser, you should consider whether the asset class in question is suitable for you. Views expressed are subject to change, and this publication cannot be construed as an advice or recommendation. This advertisement has not been reviewed by the Monetary Authority of Singapore.