Is it a good time to invest in China equities given the correction?

By FPA Investment Team | 2 August 2021

China’s economy: Review and Outlook

China’s economy expanded by 7.9% in Q2 2021

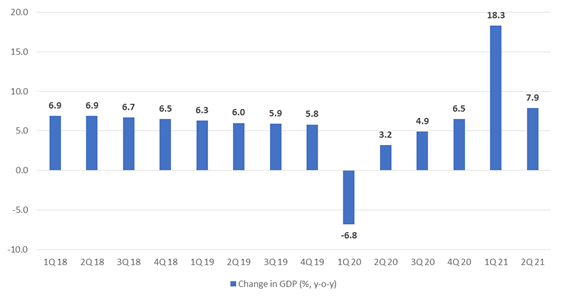

According to the National Bureau of Statistics of China (NBS), China’s economy expanded for the fifth consecutive quarter in Q2 2021. During the quarter, gross domestic product (GDP) rose by 7.9% year-on-year (yoy), following a 18.3% yoy record growth in the previous quarter as shown in Exhibit 1.

Exhibit 1: Change in China quarterly GDP (%, yoy)

Source: Data compiled from NBS

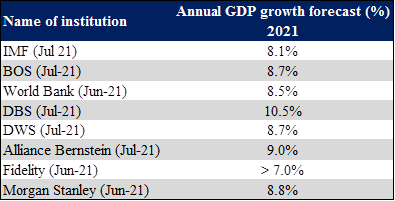

In its 14th Five-Year Plan (FYP), the Chinese government set a modest 2021 GDP growth target of at least 6.0%. The Wall Street Journal (WSJ) reported that China was being careful in managing economic expectation, given the myriad uncertainties around the coronavirus pandemic and the global recovery. The growth target of 6.0% was widely regarded by economists as conservative. Various financial institutions and fund managers are expecting the Chinese economy to sustain their strong annual growth in 2021. Annual GDP growth is projected at 7.0% – 10.5% for 2021, as shown in Exhibit 2.

Exhibit 2: China GDP growth forecasts (% yoy change)

Source: Respective financial institutions

Retail sales momentum remained stable in June

In June, China’s total retail sales of consumer goods reached 3,758.6 billion yuan, an increase of 12.1% yoy. Retail sales dropped slightly from the 12.4% yoy growth in the previous month, but on a month-on-month (mom) basis, retail sales increased by 0.7% in June. The data for China’s retail sales growth are summarized in Exhibit 3.

Exhibit 3: China’s retail sales growth (% change yoy)

Source: Data compiled from NBS

In June, retail sales in urban areas increased by 12.0% yoy to 3,255.2 billion yuan, while that for rural areas reached 503.4 billion yuan, an increase of 12.5%. By consumption type, retail sales of goods rose by 11.2% yoy to 3,366.3 billion yuan in June while catering revenue increased by 20.2% to 392.3 billion yuan. From January to June, China’s online retail sales reached 6,113.3 billion yuan, a yoy growth of 23.2%. The online retail sales of physical goods rose by 18.7% yoy. Of which, the sales of food, clothing and consumer goods increased by 23.5%, 24.1% and 16.7% respectively.

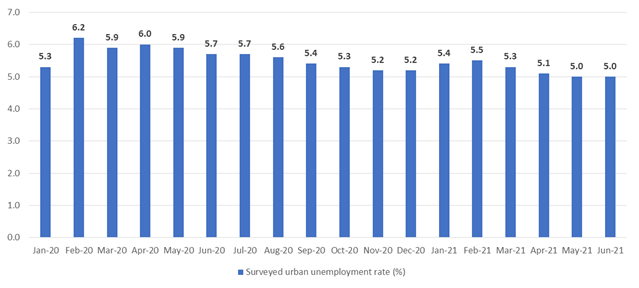

Unemployment rate remained unchanged in June

According to NBS, China’s surveyed urban employment rate remained unchanged at 5.0% in June from May, as shown in Exhibit 4.

Exhibit 4: China monthly surveyed urban unemployment rate (%)

Source: Data compiled from NBS

While the unemployment maintained, the average number of hours worked per week increased to 47.6 hours in June, from 47.3 hours in May. Further, the unemployment rate for those aged 16 to 24 remained high at 15.4%, up from 13.8% in May and just below the record high of 16.8% reached in July and August of 2020. The rise in youth unemployment, which initially appeared to be temporary consequence of the pandemic, is starting to look more durable. Currently, China is struggling to create enough suitable jobs for its more highly educated young people. Brutal competition and long working hours in the prestigious tech sector is one consequence while disengagement and discontent among those who can’t, or aren’t willing, to endure such a lifestyle is another.

Fixed asset investment slowed in June

Latest data from NBS showed that China’s fixed asset investment continued to grow in the first half of 2021, though at a slower pace than during the first five months. In the Jan-June period, fixed asset investment rose 12.6% yoy to 5,590.0 billion yuan, as compared to the 15.4% growth during the Jan-May period. The data for China’s fixed asset investment growth are summarised in Exhibit 5.

Exhibit 5: China’s growth in fixed asset investment (% change yoy)

Source: Data Compiled from NBS

By industry, the investment in primary, secondary, and tertiary industries rose by 21.3%, 16.3%, 10.7% respectively on a yoy basis. In the secondary industry, industrial investment increased by 16.2% yoy. Of which, the investment in mining industry increased by 11.5%; that of the manufacturing increased by 19.2%; and that of the production and supply of electricity, heat, gas and water increased by 3.4%.

In the tertiary industry, infrastructure investment rose by 7.8% yoy. Among them, investment in water conservancy management increased by 10.7%; investment in public facilities management increased by 6.2%; investment in road transport industry increased by 6.5%; and the investment in railway transportation industry increased by 0.4%.

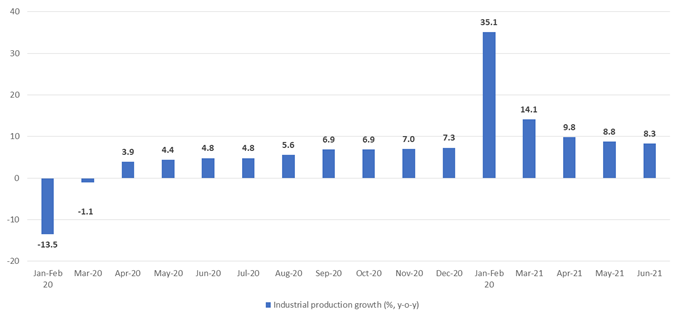

Industrial production growth continued in June

In June, China’s industrial production growth moderated from May, increasing by 8.3% yoy compared to the 8.8% yoy growth a month ago. On a mom basis, China’s industrial production increased by 0.56% in June. The data for China’s monthly industrial production growth are summarised in Exhibit 6.

Exhibit 6: China’s industrial production growth (% change yoy)

Source: Data compiled from NBS

In June, on a yoy basis, the added value of mining, manufacturing and electricity, heat, gas and water production and supply industry increased by 0.7%, 8.7% and 11.6% respectively. In terms of economic types, the added value of state-owned holding enterprises increased by 5.4% yoy; that of joint stock enterprises increased by 9.0% yoy, and that of foreign-funded enterprises & enterprises invested in Hong Kong, Macao and Taiwan increased by 6.4%

Meanwhile, in terms of industries, in June the added value of 34 of the 41 major industries maintained a yoy growth. Notable increases were seen for electrical machinery and equipment manufacturing industry (+15.0%), general equipment manufacturing industry (+13.9%), the computer, communication and other electronic equipment manufacturing industry (+13.4%) and the power and heat production and supply industry (+10.8%).

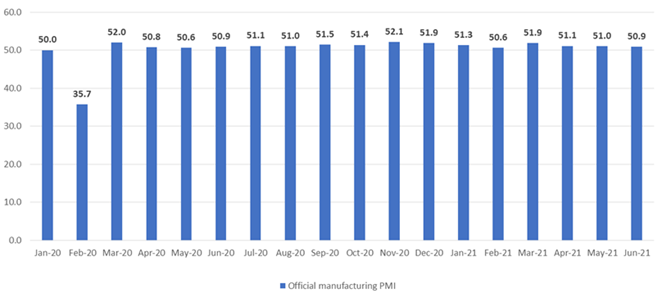

Manufacturing activity declined in June

In June, China’s official manufacturing PMI fell marginally to 50.9 from 51.0 in May, according to NBS. June’s reading marked the 16th consecutive month that the index posted above the 50 mark that separates expansion from contraction. The data for China’s official manufacturing PMI are summarised in Exhibit 7.

Exhibit 7: China’s monthly manufacturing PMI

Source: Data compiled from NBS

Meanwhile, a separate PMI survey by Caixin showed that manufacturing activity edged down from 52.0 in May to 51.3 in June. Companies indicated that the recent uptick in COVID-19 cases and supply chain difficulties weighed on output, while the pandemic dampened demand both at home and abroad. However, business confidence towards the year-ahead outlook for output remained strong in June, amid expectations that the global economy will continue to recover from the pandemic.

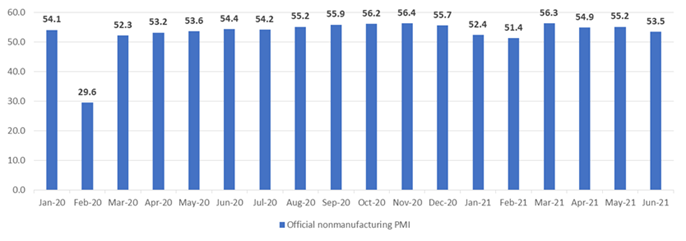

Services activity weakened in June

According to NBS, China’s official nonmanufacturing PMI, which includes services and construction activity fell to 53.5 in June from 55.2 in May. The data for China’s official nonmanufacturing PMI are summarised in Exhibit 8.

Exhibit 8: China’s monthly nonmanufacturing PMI

Source: Data compiled from NBS

The subindex measuring construction activity was unchanged at 60.1 in June, according to NBS. The subindex measuring service activity fell to 52.3 from the previous month’s 54.3, while new orders received by service providers dropped into contractionary territory, to 49.5 in June from 52.0 in May, reflecting a quick cooling of market demand. Subindexes tracking air transportation, catering and accommodation also fell into contractionary territory. The declines come as the recent Covid-19 cases in Guangdong have dampened consumer sentiment. With vaccinations relatively slow to roll out and many restrictions driven by Covid-19 still in place, consumers have remained cautious each time a new wave of infections has broken out.

Similarly, a separate survey by Caixin showed that services sector growth slowed in June. The Caixin services PMI decreased to 50.3 in June from 55.1 in May, though remaining in growth territory above the 50.0 level. The survey attributed the decrease to the uptick in COVID-19 cases and reduced travel dampened demand. Notably, both business activity and new orders rose at the slowest rates for 14 months. At the same time, there were signs of reduced pressure on capacity and business confidence softened, which led to a slight fall in employment. On the prices front, operating expenses rose only slightly in June, while prices charged fell for the first time since July 2020.

Trade surplus widened on strong export growth

China’s imports and exports posted stronger-than-expected growth in June as global demand for Chinese goods remained solid and sporadic Covid-19 outbreaks in the country’s biggest export hub didn’t hit outbound shipments as much as expected. During the period, China’s exports increased by 32.2% yoy to US$281.4 billion, according to data from the General Administration of Customs. This outperformed May’s 27.9% yoy increase. Meanwhile, China’s imports increased by 36.7% yoy to US$229.9 billion in June, lower than the 51.1% yoy jump in May. As a result, China’s trade surplus widened to US$51.5 billion in June, up from US$45.5 billion in May.

Summary of China’s economy

In summary, China’s economy expanded by 7.9% yoy in Q1 2021. Retail sales growth eased in June as recent coronavirus outbreaks hindered consumer spending. The labour market remained stable in June as the unemployment stood unchanged at 5.0%. Meanwhile, June PMI surveys suggest that manufacturing activity moderated as supply constraints hindered production, while services activity weakened on Covid-19 resurgence. On the trade front, the trade surplus widened as exports remained supported by strong demand for Chinese goods. Taken together, recent economic indicators suggest that growth appears to be on track for recovery and would achieve the 6.0% growth set by the Chinese government. Accelerating vaccination progress could stabilise the virus situation in China, which would allow for a reopening of its key services sector. This could drive up consumer spending, which is expected to be a major growth driver as China transitions toward a more consumption-driven economy. Moreover, manufacturing could also rebound as supply bottlenecks ease. Latest projections by various financial institutions suggest strong annual GDP growth of ranging from 7.0% to 10.5% for China in 2021. Barring a major virus resurgence, we are positive on China’s economic outlook.

China’s Equities: Review and Outlook

Chinese stock markets overview

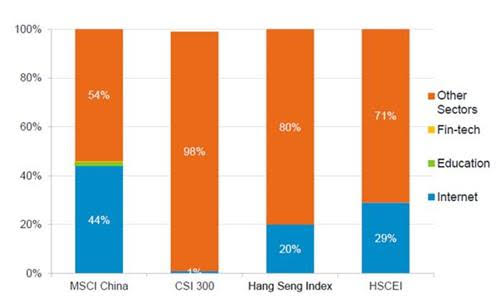

Over the past 3 months, the CSI 300 Index, Hang Seng Index, MSCI China and HSCEI fell by 6.10%, 9.62%, 13.54% and 14.71% respectively, due to concerns over the broadening scope and severity of China’s regulatory clampdown. More recently, on a one month basis, these indices respectively fell by 7.90%, 9.94%, 14.15% and 13.41%. We have summarised the performance of these indices in Exhibit 9.

Exhibit 9: China equities indices performance

Source: Data compiled from Wall Street Journal and MSCI

One reason as to why the CSI 300 did not drop as much as the other three indices could be because it has less exposure to the recent regulatory uncertainty surrounding internet stocks. According to Fidelity, the CSI 300 only has exposure of 1% in internet stocks while MSCI China, HSCEI and Hang Seng Index have exposure of 44%, 29% and 20% respectively, as shown in Exhibit 10.

Exhibit 10: Index composition: % of internet, fintech and education

Source: Fidelity

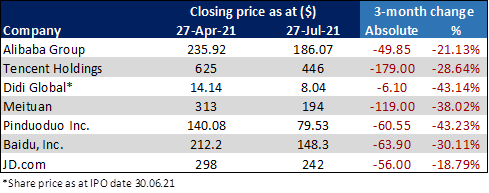

Recent regulatory clampdown on tech stocks

China has been overhauling its tech segment to rein in big technology companies, spanning issues ranging across data security, monopolistic behaviour, and financial stability. China’s regulatory scrutiny first started in late 2020 when authorities suspended the planned US$37 billion listing of Alibaba Group’s fintech arm, Ant Financial, after its controlling shareholder, Mr. Jack Ma, made a speech that infuriated government leaders. A few months later, the State Administration of Market Regulation (SAMR) fined Alibaba a record US$2.8 billion after an anti-monopoly probe found the e-commerce giant had abused its dominant market position for several years. What started out as a government crackdown on anticompetitive practices on Ant Financial and Alibaba has since ensnared other major tech companies including internet giant Tencent, ride hailing giant Didi Global and food delivery app Meituan.

Recently, SAMR blocked Tencent’s plan to merge the country’s top two videogame streaming sites, Huya and DouYu, on antitrust grounds. They also ordered the technology giant to relinquish its exclusive music label rights with record labels around the world after finding that the firm had violated antitrust laws. Tencent also announced that they would temporarily suspend their all new user registration on messaging platform, WeChat, to comply with regulations relating to an upgrade of its security systems which led to the biggest sell-off in Tencent Holdings in a decade.

Meanwhile, two days after Chinese ride-hailing giant Didi completed its initial public offering on the US stock exchange, China’s internet regulator launched an investigation into the company over how it collects user data. Chinese regulators eventually banned Didi from accepting new users and went even further by instructing the app stores to stop offering Didi’s app, causing its shares to crash.

In the latest move to tighten grip on the country’s powerful tech industry, Chinese regulators launched a probe into Meituan, a food delivery app backed by Tencent, for suspected monopolistic behaviours which prevents merchants from selling their goods on multiple platforms. Recently, Meituan’s share price plunged despite announcing that it will comply with the newly issued guidelines calling for improved standards for food delivery workers. The drop in share prices for Alibaba, Tencent, Didi, Meituan and other tech giants over the past 3 months are shown in Exhibit 11.

Exhibit 11: Summary of share price decline for Chinese tech giants

Source: Data compiled from Yahoo Finance

Further, China also announced new regulations to ban companies that teach school curriculum subjects from making profits, raising capital or going public. Institutions will also be banned from offering education services during the weekends and school breaks which led to a sell-off in Chinese education stock. Fears of a broader crackdown on private enterprises are now mounting as the clampdown in some ways mirrors China’s broader campaign against the growing power of domestic internet companies.

Following its latest crackdowns, China’s Ministry of Industry and Information Technology (MIIT) announced a six-month campaign to address issues regarding internet apps violating consumer rights, cyber security and “disturbing market order”. The increased scrutiny spooked investors and weighed on consumer sentiment.

Despite the regulatory clampdown, HSBC believes Chinese equities valuations within the affected sectors could recover once uncertainty is removed as they are supported by steady macroeconomic performance and structural growth opportunities. Credit Suisse highlighted that they may shift to a more positive stance on Chinese equities soon but advised investors to be patient and disciplined. In contrast, Morgan Stanley reiterated their call to downgrade Chinese stocks as it believes the equity risk premium could rise across the board for Chinese equities and the attractiveness of Chinese equities could diminish. Meanwhile, Blackrock adopts a neutral stance as it believes that “China is pushing through reforms that could weigh on the quantity of growth in the near term but potentially improve the quality in the long-run”.

Implications on the property and healthcare industry

The latest moves, covering both education and technology, made clear that China is willing to inflict substantial market pain to meet its social and regulatory goals, according to WSJ. There are concerns that regulatory tightening could expand to hit more industries such as property and healthcare. Reuters reported that China’s central bank recently ordered lenders in Shanghai to raise the rate of mortgage loans for first time home buyers from 4.65% to 5% following the statement from China’s housing ministry that they will strive to clean up irregularities in the property market in three years. In a separate report, Reuters highlighted that medical expenses are one of three key areas of living costs seen as targets for social change. These heightened expectations that authorities may make healthcare their next focus of market reform.

Meanwhile, recent remarks by financial institutions suggest mixed views on how other sectors could be impacted. BNP Paribas believes that social equality, demographics and national security will likely become the core drivers of further regulations in China. In particular, sectors closely related to gig workers (e.g. express delivery, food delivery, solo car and truck drivers) as well as companies that provide basic social infrastructure are likely to be subjected to higher risks (e.g. healthcare internet platform, consumable medical device / equipment, etc.). Conversely, UBS noted that the curbs imposed on the education industry will not be replicated broadly in other sectors as it believes the recent regulatory drive does not signal a wholesale crackdown on the capital market or to stifle innovation, but to ensure businesses are conducted in a sustainable way.

Is it a good time to invest in China equities given the correction?

Based on MSCI data, the MSCI China index was recently trading at a forward PE and PB multiple of 14.39x and 2.04x respectively. We believe that current valuations for China equities are moderate, and there are still opportunities to enter the stock market. However, while the outlook on tech regulatory scrutiny in China remains uncertain in the short-term, we believe the tech industry remains a vital driver of China’s long term growth.

In its 14th Five Year Plan (FYP), China’s government highlighted the goal of achieving self-sufficiency in key technologies like semi-conductors and artificial technology. According to Fidelity, the Chinese government aims to deploy massive investments in technology and digitalisation, with projected investments of approximately US$1.5 trillion across intercity high-speed rail & rail transportation, 5G network infrastructure and big data centers, among others, by 2025. A breakdown of the projected investments is outlined in Exhibit 12.

Exhibit 12: Projected investment amount for various sectors

Source: Fidelity

Another key strategic pillar outlined in the 14th FYP would be the focus on raising domestic consumption through the ‘dual circulation’ model, which mainly involves tapping into China’s large domestic market of consumers. According to Fidelity, the Covid-19 pandemic has resulted in a structural shift to online usage in China, with Chinese consumers intending to continue this new lifestyle trend. Data compiled by Fidelity showed Chinese consumers were most likely to continue with online usage in areas like in-store self-checkout, watching e-sports, restaurant delivery and personal video chat. Against this backdrop, we are inclined to believe that online retailing in China should remain a resilient sector.

Further, the 14th FYP also highlighted China’s plan to strengthen its sustainability commitments. As part of its sustainability goals, China aims to reach peak carbon emissions by 2030 and achieve carbon neutrality by 2060. This will provide opportunities in areas like renewable energy, electronic vehicles (EV) and technology, according to Fidelity. Specifically, sectors to benefit include solar/wind equipment manufacturers, EV, battery makers and power/grid equipment makers, among others, as shown in Exhibit 13.

Exhibit 13: Sectors to benefit from China’s net-zero carbon target

Source: Fidelity

In our view, the 14th FYP will strengthen domestic consumption and provide opportunities for companies to grow and expand. Sectors like clean energy and online retailing are expected to benefit from strong government investments. Our confidence in China equities remains intact and the key is now stock selection.

What are the best funds to invest in?

As part of our proprietary fund selection process, we have reviewed a range of China equity funds based on their risk-adjusted returns and risk metrics like sharpe ratio & beta, among others. We have included below a summary of the returns of these funds, as shown in Exhibit 14.

Exhibit 14: Summary of the returns of China equity funds

For those who are keen to increase their exposure to China equities, please contact us to find out which fund is best positioned to benefit from the continuous long-term growth in China. Please email Glendon at research@fpafinancial.com or Fabian at investment@fpafinancial.com.

Disclaimer: This publication is for information and general circulation only. It does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. You should seek advice from a financial adviser before investing in the above-mentioned asset class. If you choose not to seek advice from a financial adviser, you should consider whether the asset class in question is suitable for you. Views expressed are subject to change, and this publication cannot be construed as an advice or recommendation. This advertisement has not been reviewed by the Monetary Authority of Singapore.